Business, 30.07.2021 01:50 belindajolete

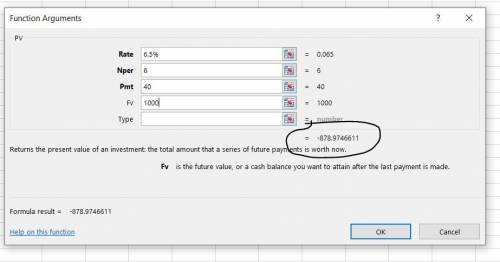

Both Bond Sam and Bond Dave have 8 percent coupons, make semiannual payments, and are priced at par value. Bond Sam has 3 years to maturity, whereas Bond Dave has 18 years to maturity. If interest rates suddenly rise by 5 percent, what is the percentage change in the price of Bond Sam

Answers: 1

Other questions on the subject: Business

Business, 21.06.2019 19:30, ceceshelby51631

What would be the input, conversion and output of developing a new soft drink

Answers: 3

Business, 22.06.2019 11:10, henryzx900

How much are you willing to pay for a zero that matures in 10 years, has a face value of $1,000 and your required rate of return is 7%? round to the nearest cent. do not include a dollar sign in your answer. (i. e. if your answer is $432.51, then type 432.51 without $ sign)

Answers: 1

Business, 22.06.2019 12:50, HarleyQuinn117

Performance bicycle company makes steel and titanium handle bars for bicycles. it requires approximately 1 hour of labor to make one handle bar of either type. during the most recent accounting period, barr company made 7,700 steel bars and 2,300 titanium bars. setup costs amounted to $35,000. one batch of each type of bar was run each month. if a single company-wide overhead rate based on direct labor hours is used to allocate overhead costs to the two products, the amount of setup cost assigned to the steel bars will be:

Answers: 2

You know the right answer?

Both Bond Sam and Bond Dave have 8 percent coupons, make semiannual payments, and are priced at par...

Questions in other subjects:

Mathematics, 14.03.2020 04:15

Mathematics, 14.03.2020 04:15