Business, 29.05.2021 02:40 YamiletRdz721

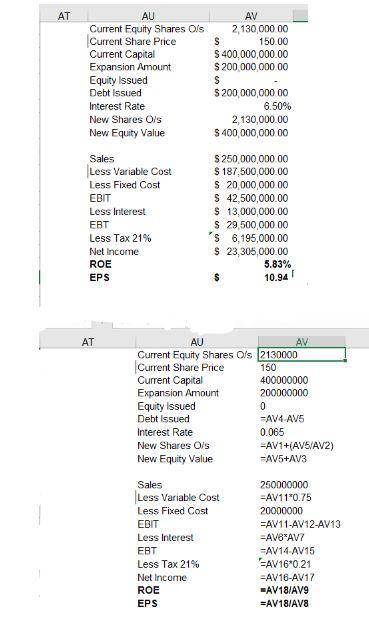

Spyder Mann has expected sales of $250 million a year. Variable costs are expected to be 75 percent of sales and fixed operating costs are $20000000 a year. Total capital is presently $400000000 and must be expanded to $600000000 to generate the anticipated sales level. The company presently has no debt outstanding, and 2130000 shares of stock. Additional common stock could be sold for $150 a share. The interest rate on new debt would be 6.5 percent and the tax rate is 21 percent. Compute the return on equity and earnings per share assuming the expansion is financed: Sales of $250 million, Var. cost of 75% of sales, Fixed cost of $20000000 per year, new capital needed $200000000 ($600000000 - $400000000), number of shares 2130000 shares, stock price of $150, interest expense of 6.5%, tax of 21%, assume no preferred dividends. a. exclusively with debt, b. exclusively with equity and c. with one-half debt and one-half equity. Calculate return on equity (ROE) and earnings per share (EPS) if expansion is financed by debt.

Answers: 3

Other questions on the subject: Business

Business, 22.06.2019 11:30, levy72

10. lucy is catering an important luncheon and wants to make sure her bisque has the perfect consistency. for her bisque to turn out right, it should have the consistency of a. cold heavy cream. b. warm milk. c. foie gras. d. thick oatmeal. student d incorrect

Answers: 2

Business, 22.06.2019 14:20, clairajogriggsk

Your uncle borrows $53,000 from the bank at 11 percent interest over the nine-year life of the loan. use appendix d for an approximate answer but calculate your final answer using the formula and financial calculator methods. what equal annual payments must be made to discharge the loan, plus pay the bank its required rate of interest

Answers: 1

Business, 22.06.2019 17:00, nawaphon1395

Alpha company uses the periodic inventory system for purchase & sales of merchandise. discount terms for both purchases & sales are, 2/10, n30 and the gross method is used. unless otherwise noted, fob destination will apply to all purchases & sales. the value of inventory is based on periodic system. on january 1, 2016, beginning inventory consisted of 350 units of widgets costing $10 each. alpha prepares monthly income statements. the following events occurred during the month of jan.: dateactivitya. jan. 3purchased on account 350 widgets for $11 each. b.jan. 5sold on account 400 widgets for $30 each. paid freight out with petty cash of $150.c. jan. 10purchased on account 625 widgets for $12 each. d.jan. 11shipping cost for the january 10 purchased merchandise was $400 was paid with a cheque by alpha directly to the freight company. e.jan. 12returned 50 widgets received from jan. 10 purchase as they were not the correct item ordered. f.jan. 13paid for the purchases made on jan. 3.g. jan. 21sold on account 550 widgets for $30 each. paid freight out with petty cash of $250.h. jan. 22authorize credit without return of goods for 50 widgets sold on jan. 21 when customer advised that they were received in defective condition. i.jan. 25received payment for the sale made on jan. 5.j. jan. 26paid for the purchases made on jan. 10.k. jan. 31received payment for the sale made on jan. 21.use this information to prepare the general journal entries (without explanation) for the january events. if no entry is required then enter the date and write "no entry required."

Answers: 2

Business, 22.06.2019 19:00, shey89

Question 55 ted, a supervisor for jack's pool supplies, was accused of stealing pool supplies and selling them to friends and relatives at reduced prices. given ted's earlier track record, he was not fired immediately. the authorities decided to give him an administrative leave, without pay, until the investigation was complete. in view of the given information, it would be most appropriate to say that ted was: demoted. discharged. suspended. dismissed.

Answers: 2

You know the right answer?

Spyder Mann has expected sales of $250 million a year. Variable costs are expected to be 75 percent...

Questions in other subjects:

Mathematics, 30.08.2019 23:30

Mathematics, 30.08.2019 23:30

Physics, 30.08.2019 23:30