Condensed financial data of bridgeport corp. follow.

bridgeport corp.

comparative...

Business, 06.12.2019 06:31 trujillo03

Condensed financial data of bridgeport corp. follow.

bridgeport corp.

comparative balance sheets

december 31

assets

2017

2016

cash

$ 151,096

$ 90,508

accounts receivable

164,186

71,060

inventory

210,375

192,330

prepaid expenses

53,108

48,620

long-term investments

258,060

203,830

plant assets

532,950

453,475

accumulated depreciation

(93,500

)

(97,240

)

total

$1,276,275

$962,583

liabilities and stockholders’ equity

accounts payable

$ 190,740

$ 125,851

accrued expenses payable

30,855

39,270

bonds payable

205,700

273,020

common stock

411,400

327,250

retained earnings

437,580

197,192

total

$1,276,275

$962,583

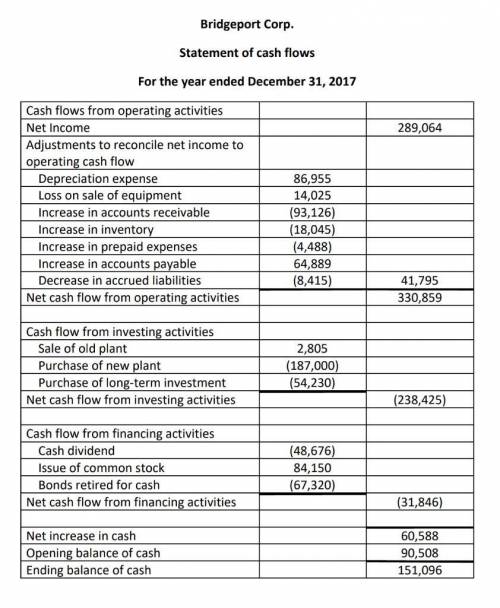

bridgeport corp.

income statement data

for the year ended december 31, 2017

sales revenue

$726,420

less:

cost of goods sold

$253,310

operating expenses, excluding depreciation

23,207

depreciation expense

86,955

income tax expense

51,014

interest expense

8,845

loss on disposal of plant assets

14,025

437,356

net income

$ 289,064

Answers: 2

Other questions on the subject: Business

Business, 21.06.2019 21:10, BABA3724

Auniversity spent $1.8 million to install solar panels atop a parking garage. these panels will have a capacity of 400 kilowatts (kw) and have a life expectancy of 20 years. suppose that the discount rate is 20%, that electricity can be purchased at $0.10 per kilowatt-hour (kwh), and that the marginal cost of electricity production using the solar panels is zero. hint: it may be easier to think of the present value of operating the solar panels for 1 hour per year first. approximately how many hours per year will the solar panels need to operate to enable this project to break even? a. a.3,696.48 b.14,785.92 c.9,241.20 if the solar panels can operate only for 8,317 hours a year at maximum, the project (would/would not)break even?

Answers: 1

Business, 22.06.2019 03:00, itscheesycheedar

Compare the sources of consumer credit 1. consumers use a prearranged loan using special checks 2. consumers use cards with no interest and non -revolving balances 3. consumers pay off debt and credit is automatically renewed 4. consumers take out a loan with a repayment date and have a specific purpose a. travel and entertainment credit b. revolving check credit c. closed-end credit d. revolving credit

Answers: 1

Business, 22.06.2019 06:30, silas99

Selected data for stick’s design are given as of december 31, year 1 and year 2 (rounded to the nearest hundredth). year 2 year 1 net credit sales $25,000 $30,000 cost of goods sold 16,000 18,000 net income 2,000 2,800 cash 5,000 900 accounts receivable 3,000 2,000 inventory 2,000 3,600 current liabilities 6,000 5,000 compute the following: 1. current ratio for year 2 2. acid-test ratio for year 2 3. accounts receivable turnover for year 2 4. average collection period for year 2 5. inventory turnover for year 2

Answers: 2

Business, 22.06.2019 20:10, boofpack9775

As the inventor of hypertension medication, onesure pharmaceuticals (osp) inc. was able to reap the benefits of economies of scale due to a large consumer demand for the drug. even when competitors later developed similar drugs after the expiry of osp's patents, regular users did not want to switch because they were concerned about possible side effects. which of the following benefits does this scenario best illustrate? a. first-mover advantages b. social benefits c. network externalities d. fringe benefits

Answers: 3

You know the right answer?

Questions in other subjects:

Mathematics, 06.05.2020 01:59

Spanish, 06.05.2020 01:59

Mathematics, 06.05.2020 01:59

Mathematics, 06.05.2020 01:59