Business, 27.11.2019 21:31 ayoismeisalex

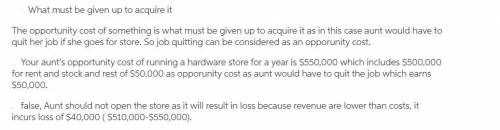

Your aunt is thinking about opening a hardware store. she estimates that it would cost $500,000 per year to rent the location and buy the stock. in addition, she would have to quit her $50,000 per year job as an accountant. what is the opportunity cost of something? what you pay for it the time it takes to do something what must be given up to acquire it the cost to produce it your aunt's opportunity cost of running a hardware store for a year is $ . suppose your aunt thought she could sell $510,000 worth of merchandise in a year. your aunt open the store.

Answers: 2

Other questions on the subject: Business

Business, 22.06.2019 06:30, brony2199

"in my opinion, we ought to stop making our own drums and accept that outside supplier's offer," said wim niewindt, managing director of antilles refining, n. v., of aruba. "at a price of $21 per drum, we would be paying $4.70 less than it costs us to manufacture the drums in our own plant. since we use 70,000 drums a year, that would be an annual cost savings of $329,000." antilles refining's current cost to manufacture one drum is given below (based on 70,000 drums per year):

Answers: 1

Business, 22.06.2019 11:00, PastyMexican24

On analyzing her company’s goods transport route, simone found that they could reduce transport costs by a quarter if they merged different transport routes. what role (job) does simone play at her company? simone is at her company.

Answers: 1

Business, 22.06.2019 12:30, bella51032

True or false entrepreneurs try to meet the needs of the marketplace by supplying a service or product

Answers: 1

Business, 22.06.2019 12:30, cuppykittyy

Acorporation a. can use different depreciation methods for tax and financial reporting purposes b. must use the straight - line depreciation method for tax purposes and double declining depreciation method financial reporting purposes c. must use different depreciation method for tax purposes, but strictly mandated depreciation methods for financial reporting purposes d. can use straight- line depreciation method for tax purposes and macrs depreciation method financial reporting purposes

Answers: 2

You know the right answer?

Your aunt is thinking about opening a hardware store. she estimates that it would cost $500,000 per...

Questions in other subjects:

Mathematics, 21.06.2019 19:00

Mathematics, 21.06.2019 19:00

Biology, 21.06.2019 19:00