Business, 26.11.2019 05:31 maddyclark19

On january 1, 2018, the general ledger of grand finale fireworks includes the following account balances:

accounts debit credit

cash $ 43,200

accounts receivable 45,500

supplies 8,000

equipment 69,000

accumulated depreciation $ 9,500

accounts payable 15,100

common stock, $1 par value 15,000

additional paid-in capital 85,000

retained earnings 41,100

totals $ 165,700 $ 165,700

during january 2018, the following transactions occur:

january 2 issue an additional 2,000 shares of $1 par value common stock for $40,000.

january 9 provide services to customers on account, $15,600.

january 10 purchase additional supplies on account, $5,400.

january 12 repurchase 1,200 shares of treasury stock for $17 per share.

january 15 pay cash on accounts payable, $17,000.

january 21 provide services to customers for cash, $49,600.

january 22 receive cash on accounts receivable, $17,100.

january 29 declare a cash dividend of $0.30 per share to all shares outstanding on january 29. the dividend is payable on february 15. (hint: grand finale fireworks had 15,000 shares outstanding on january 1, 2018 and dividends are not paid on treasury stock.)

january 30 reissue 800 shares of treasury stock for $19 per share.

january 31 pay cash for salaries during january, $42,500.

1. record each of the transactions listed above.

a. unpaid utilities for the month of january are $6,700.

b. supplies at the end of january total $5,600.

c. depreciation on the equipment for the month of january is calculated using the straight-line method. at the time the equipment was purchased, the company estimated a service life of three years and a residual value of $10,500.

d. accrued income taxes at the end of january are $2,500.

2. record the adjusting entries on january 31, 2018 for the above transactions.

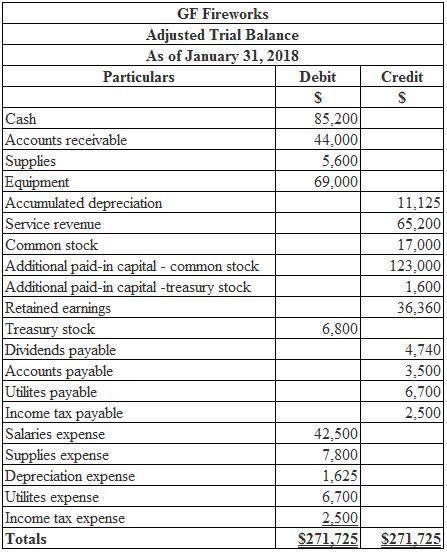

3. prepare an adjusted trial balance as of january 31, 2018.

4. prepare a multiple-step income statement for the period ended january 31, 2018.

5. prepare a classified balance sheet as of january 31, 2018.

on january 1, 2018, the general ledger of grand finale fireworks includes the following account balances: accounts debit credit cash $ 43,200 accounts receivable 45,500 supplies 8,000 equipment 69,000 accumulated depreciation $ 9,500 accounts payable 15,100 common stock, $1 par value 15,000 additional paid-in capital 85,000 retained earnings 41,100 totals $ 165,700 $ 165,700

Answers: 1

Other questions on the subject: Business

Business, 22.06.2019 05:50, mandy9386

Nichols inc. manufactures remote controls. currently the company uses a plantminuswide rate for allocating manufacturing overhead. the plant manager is considering switchingminusover to abc costing system and has asked the accounting department to identify the primary production activities and their cost drivers which are as follows: activities cost driver allocation rate material handling number of parts $5 per part assembly labor hours $20 per hour inspection time at inspection station $10 per minute the current traditional cost method allocates overhead based on direct manufacturing labor hours using a rate of $20 per labor hour. what are the indirect manufacturing costs per remote control assuming an method is used and a batch of 10 remote controls are produced? the batch requires 100 parts, 5 direct manufacturing labor hours, and 3 minutes of inspection time.

Answers: 2

Business, 22.06.2019 12:30, cheyannehatton

Suppose that two firms produce differentiated products and compete in prices. as in class, the two firms are located at two ends of a line one mile apart. consumers are evenly distributed along the line. the firms have identical marginal cost, $60. firm b produces a product with value $110 to consumers. firm a (located at 0 on the unit line) produces a higher quality product with value $120 to consumers. the cost of travel are directly related to the distance a consumer travels to purchase a good. if a consumerhas to travel a mile to purchase a good, the incur a cost of $20. if they have to travel x fraction of a mile, they incur a cost of $20x. (a) write down the expressions for how much a consumer at location d would value the products sold by firms a and b, if they set prices p_{a} and p_{b} ? (b) based on your expressions in (a), how much will be demanded from each firm if prices p_{a} and p_{b} are set? (c) what are the nash equilibrium prices?

Answers: 3

Business, 23.06.2019 00:00, Brandon4188

Which example would the government consider as intellectual property? a. product design that contains a hologram of the logo of the company b. a copy of a famous artist’s painting in a new medium c. a plant species discovered in the united states for the first time d. a method of production that is common to an entire industry e. a discount structure offered to the customer at a store

Answers: 3

Business, 23.06.2019 02:50, shay03littletop5kx2p

In the market for lock washers, a perfectly competitive market, the current equilibrium price is $5 per box. washer king, one of the many producers of washers, has a daily short-run total cost given by tc = 190 + 0.20q + 0.0025q2, where q measures boxes of washers. washer king's corresponding marginal cost is mc = 0.20 + 0.005q. how many boxes of washers should washer king produce per day to maximize profit?

Answers: 1

You know the right answer?

On january 1, 2018, the general ledger of grand finale fireworks includes the following account bala...

Questions in other subjects:

Biology, 30.05.2020 12:58

History, 30.05.2020 12:58

Mathematics, 30.05.2020 12:58