Business, 24.11.2019 22:31 kyramillerr8639

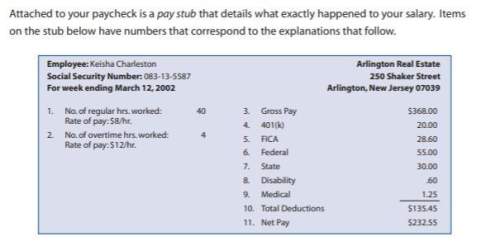

1. a standard work week is 40 hours. employers must pay the agreed-upon hourly rate of pay for these hours. here, 40 hours x $8/hr. = 320.00

2. employers usually pay one-and-a-half time the standard hourly rate for any hours over 40 that are worked. half of $8 is $4 so the overtime rate is $8+4$=$12. keisha's overtime pay is 4 hours x $12/hr. = 48.00

3. gross pay is total earnings (standard and overtime) before taxes and deductions. gross pay in the case is $320.00 + $48.00 = $368.00

4. 401(k) is a retirement account contribution that is tax-free until your retire. for the year 2003, individuals 50 years or older can contribute up to a maximum of 13,000 to this fund annually. individuals under the age for 50 can contribute up to 12,000

5. fica stands for federal insurance contribution act. this is the money that is deducted and put into your social security fund. your social security fund holds a percentage of your earnings averaged over most of your working lifetime. social security was never intended to be your only source of income when you retire or become disabled, or your family's only income if you die. it is intended to supplement other income you have from pension plans, saving investments, etc. currently, each one of your paychecks will be reduced by 7.65% specifically for your fica contribution. your employer is required by law to match this same amounr and pay it to social security

Answers: 1

Other questions on the subject: Business

Business, 21.06.2019 23:50, amandajennings01

Juan has a retail business selling skateboard supplies he maintains large stockpiles of every item he sells in a warehouse on the outskirts of town he keeps finding that he has to reorder certain supplies all the time but others only once a year how can he solve this problem?

Answers: 1

Business, 22.06.2019 03:00, JadaaJayy

Insurance companies have internal controls in place to protect assets, monitor the accuracy of accounting records and encourage operational efficiencies and adherence to policies. these internal controls are generally of two types: administrative controls and accounting controls. administrative controls are the policies and procedures that guide the daily actions of employees. accounting controls are the policies and procedures that delineate authorizations of financial transactions that are done, safeguard assets, and provide reports on the company’s financial status in a reliable and timely manner. internal controls should include both preventative and detective controls. the purpose of preventative controls is to stop problems and errors before they occur. detective controls identify problems after they have occurred. preventative controls are usually more effective at reducing problems, but they also tend to be more expensive. internal controls must be flexible to adjust for changes in laws and regulations in addition to adding new products or modifying current ones. companies must also do regular analyses to ensure that the benefits of implementing the controls are worth their costs. when concerned about paying unwarranted insurance claims which type of control would be useful?

Answers: 2

Business, 22.06.2019 16:50, taylorb9893

According to ceo heidi ganahl, camp bow wow requires a strong and consistent corporate culture to keep all local franchise owners "on the same page" and to follow a common template for the business and brand. this culture could become detrimental over time because: (a) strong consistent cultures are inflexible and incapable of adapting to environmental change (b) strong consistent cultures are too flexible and capable of adapting to environmental change (c) strong consistent cultures don’t perform well in any environment (d) the passing of time provides stability and predictability for businesses

Answers: 2

Business, 22.06.2019 19:40, QueenNerdy889

An increase in the market price of men's haircuts, from $16 per haircut to $26 per haircut, initially causes a local barbershop to have its employees work overtime to increase the number of daily haircuts provided from 20 to 25. when the $26 market price remains unchanged for several weeks and all other things remain equal as well, the barbershop hires additional employees and provides 40 haircuts per day. what is the short-run price elasticity of supply? nothing (your answer should have two decimal places.) what is the long-run price elasticity of supply? nothing (your answer should have two decimal places.)

Answers: 1

You know the right answer?

1. a standard work week is 40 hours. employers must pay the agreed-upon hourly rate of pay for these...

Questions in other subjects:

Health, 24.06.2019 02:00

Chemistry, 24.06.2019 02:00