Business, 21.11.2019 04:31 ewalchloe5067920

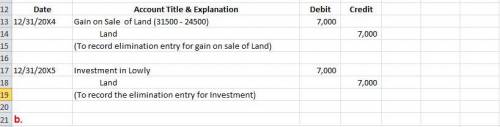

Huckster corporation purchased land on january 1, 20x1, for $24,500. on june 10, 20x4, it sold the land to its subsidiary, lowly corporation, for $31,500. huckster owns 60 percent of lowly’s voting shares. required: a. prepare the worksheet consolidation entries needed to remove the effects of the intercompany sale of land in preparing the consolidated financial statements for 20x4 and 20x5. (if no entry is required for a transaction/event, select "no journal entry required" in the first account field.)*record the consolidating entry on december 31, 20x4.*record the consolidating entry on december 31, 20x5.b. prepare the worksheet consolidation entries needed on december 31, 20x4 and 20x5, if lowly had initially purchased the land for $24,500 and then sold it to huckster on june 10, 20x4, for $31,500. (if no entry is required for a transaction/event, select "no journal entry required" in the first account field.)*record the consolidating entry on december 31, 20x4.*record the consolidating entry on december 31, 20x5.

Answers: 1

Other questions on the subject: Business

Business, 22.06.2019 01:50, jjaheimhicks3419

Amanda rice has just arranged to purchase a $640,000 vacation home in the bahamas with a 20 percent down payment. the mortgage has a 7 percent apr compounded monthly and calls for equal monthly payments over the next 30 years. her first payment will be due one month from now. however, the mortgage has an eight-year balloon payment, meaning that the balance of the loan must be paid off at the end of year 8. there were no other transaction costs or finance charges. how much will amanda’s balloon payment be in eight years

Answers: 3

Business, 22.06.2019 05:30, junior2461

Identify the three components of a family's culture and provide one example from your own experience

Answers: 2

Business, 22.06.2019 06:40, haleyturkey

Depreciation on the company's equipment for 2017 is computed to be $18,000.the prepaid insurance account had a $6,000 debit balance at december 31, 2017, before adjusting for the costs of any expired coverage. an analysis of the company's insurance policies showed that $1,100 of unexpired insurance coverage remains. the office supplies account had a $700 debit balance on december 31, 2016; and $3,480 of office supplies were purchased during the year. the december 31, 2017, physical count showed $300 of supplies available. two-thirds of the work related to $15,000 of cash received in advance was performed this period. the prepaid insurance account had a $6,800 debit balance at december 31, 2017, before adjusting for the costs of any expired coverage. an analysis of insurance policies showed that $5,800 of coverage had expired. wage expenses of $3,200 have been incurred but are not paid as of december 31, 2017.

Answers: 3

Business, 22.06.2019 13:30, bobbycisar1205

Hundreds of a bank's customers have called the customer service call center to complain that they are receiving text messages on their phone telling them to access a website and enter personal information to resolve an issue with their account. what action should the bank take?

Answers: 2

You know the right answer?

Huckster corporation purchased land on january 1, 20x1, for $24,500. on june 10, 20x4, it sold the l...

Questions in other subjects:

Spanish, 26.10.2020 20:50

Mathematics, 26.10.2020 20:50

Mathematics, 26.10.2020 20:50

Mathematics, 26.10.2020 20:50

Social Studies, 26.10.2020 20:50