Business, 23.08.2019 02:20 miguel454545

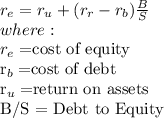

An all-equity firm has a return on assets of 15.3 percent. the firm is considering converting to a debt-equity ratio of 0.30. the pre-tax cost of debt is 8.1 percent. ignoring taxes, what will the cost of equity be if the firm switches to the leveraged capital structure

Answers: 2

Other questions on the subject: Business

Business, 22.06.2019 01:30, rhettperkins

Emil motycka is considered an entrepreneur because

Answers: 2

Business, 22.06.2019 14:30, ayoismeisjjjjuan

Amethod of allocating merchandise cost that assumes the first merchandise bought was the first merchandise sold is called the a. last-in, first-out method. b. first-in, first-out method. c. specific identification method. d. average cost method.

Answers: 3

Business, 22.06.2019 16:30, emmmssss21

Bernard made a gift of $500,000 to his brother in 2014. due to bernard’s prior taxable gifts he paid $200,000 of gift tax. when bernard died in 2019, the applicable gift tax credit had increased. at bernard’s death, what amount related to the $500,000 gift to his brother is included in his gross estate?

Answers: 3

You know the right answer?

An all-equity firm has a return on assets of 15.3 percent. the firm is considering converting to a d...

Questions in other subjects:

Biology, 21.07.2019 09:00

Mathematics, 21.07.2019 09:00

Computers and Technology, 21.07.2019 09:00