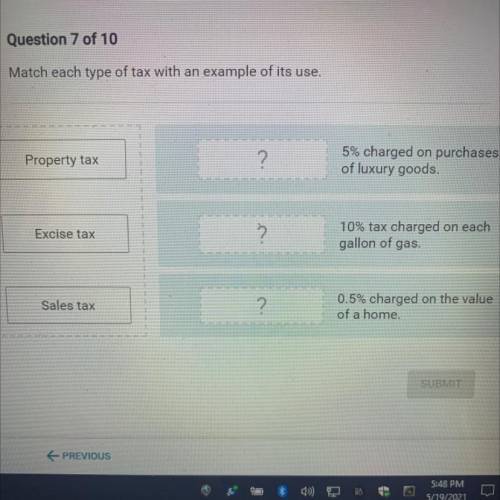

Match each type of tax with an example of its use.

Property tax

?

5% charged on purchas...

Social Studies, 20.05.2021 01:00 electrofy456

Match each type of tax with an example of its use.

Property tax

?

5% charged on purchases

of luxury goods.

Excise tax

?

10% tax charged on each

gallon of gas.

Sales tax

?

0.5% charged on the value

of a home.

Answers: 3

Other questions on the subject: Social Studies

Social Studies, 22.06.2019 08:10, chandranewlon

What did mrs zog say when mr zog said he was going mountain climbing in the himalayas answer key?

Answers: 2

Social Studies, 23.06.2019 05:20, hdjsjshshsh

4. write short introduction to aaran and jaanto technology.

Answers: 2

Social Studies, 23.06.2019 05:30, live4dramaoy0yf9

An employee of the state government always received his state paycheck on the last workday of the month. the employee was not a good money manager, and just barely managed to make it from paycheck to paycheck each month. on the second to the last workday of the month, the employee had $45 in his checking account, and, needing to buy a birthday gift for his sister, he wrote a check to a gift boutique for $100. he knew that he would be receiving his paycheck the next day, so he could deposit the paycheck before the check would be sent to the bank. however, unbeknownst to the employee, the state legislature was having a budget impasse. because the state constitution prohibited any deficit spending, state employees were not paid as usual. without a paycheck to deposit, the check written to the gift boutique was returned for insufficient funds. the merchant complained to the police, who arrested the employee and charged him under a statute that prohibited "issuing a check knowing that it is drawn against insufficient funds, with intent to defraud the payee of the check."what should be the outcome of the employee's prosecution? a not guilty, because the employee intended to deposit his paycheck the next day. b not guilty, because it was reasonable for the employee to expect that he would receive his paycheck as usual. c guilty, because the employee knew when he wrote the check that he did not have sufficient funds in his account to honor it. d guilty, because reliance on a future source of income does not vitiate the employee's violation of the statute when he wrote the check.

Answers: 2

Social Studies, 23.06.2019 10:00, chriscook9965

What are the five traits of a civilization?

Answers: 1

You know the right answer?

Questions in other subjects:

Social Studies, 22.04.2021 21:00

Mathematics, 22.04.2021 21:00

English, 22.04.2021 21:00

Mathematics, 22.04.2021 21:00