Social Studies, 07.07.2019 05:30 babygirl091502

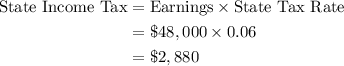

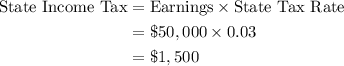

Jamal is a nurse and earns $48,000 per year. he lives in california and pays about 6 percent of his income in state income taxes. his sales tax rate is 8 percent. diamond is an accountant and earns $50,000 per year. she lives in arizona and pays about 3 percent of her income in state income taxes. her sales tax rate is 9.5 percent. jamal and diamond are calculating their taxes for the year. they both have no dependents, so their federal tax rates are the same. who would pay more in federal income taxes? who would pay more in sales taxes when making purchases?

Answers: 1

Other questions on the subject: Social Studies

Social Studies, 22.06.2019 00:30, sirinapadeangel

Identify three different reasons of why people have had to migrate and give examples to justify your reasons. use 3-6 sentences to explain your response.

Answers: 1

Social Studies, 22.06.2019 09:10, slend3rpiggy

Situation #1: imagine that you are a free black male living in columbus, oh in 1863. you have seen the recruiting poster and have been thinking a lot about whether or not to enlist in the union army. write a one-page letter (double spaced) to your mother telling her of the decision you have made about enlisting (or not enlisting). be sure to explain the reasons that caused you to make the decision.

Answers: 1

Social Studies, 22.06.2019 10:30, oliviaschmitt0

What would you call a political system that is only meant to last for a short time

Answers: 3

Social Studies, 23.06.2019 00:30, brooklynmikestovgphx

Compare and contrast walden and "the experiences of the a. c." include the authors, their ideas, and reasons of their failures from a christian perspective.

Answers: 2

You know the right answer?

Jamal is a nurse and earns $48,000 per year. he lives in california and pays about 6 percent of his...

Questions in other subjects:

Mathematics, 13.06.2020 03:57

Mathematics, 13.06.2020 03:57

Mathematics, 13.06.2020 03:57

Mathematics, 13.06.2020 03:57