Mathematics, 06.12.2021 20:30 ChristLover2863

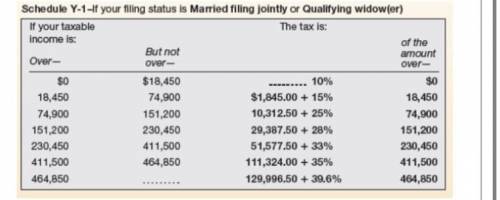

Jake and Gloria are married, filing jointly. Their taxable income without deductions was $406,498. They were able to reduce their total income by $25,381 with deductions. Using Form 1040 and Schedule A, how much was their tax by taking these deductions? Use the schedule below.

Answers: 3

Other questions on the subject: Mathematics

Mathematics, 21.06.2019 17:30, hailscooper7363

Simplify this expression.2(10) + 2(x – 4) a. 2x + 16 b. x + 12 c. 2x + 12 d. x + 16

Answers: 2

Mathematics, 21.06.2019 18:00, ReeseMoffitt8032

In a graph with several intervals o data how does a constant interval appear? what type of scenario produces a constant interval?

Answers: 1

Mathematics, 21.06.2019 20:00, anthonybowie99

Write the point-slope form of the line passing through (2, -12) and parallel to y=3x.

Answers: 3

You know the right answer?

Jake and Gloria are married, filing jointly. Their taxable income without deductions was $406,498. T...

Questions in other subjects:

Biology, 27.03.2021 22:20

Mathematics, 27.03.2021 22:20

Chemistry, 27.03.2021 22:20

Mathematics, 27.03.2021 22:20