Mathematics, 28.10.2021 03:00 TrueKing184

Consider the following table:

Scenario Probability Stock Fund Rate of Return Bond FundRate of Return

Severe recession 0.10 −40% −13%

Mild recession 0.20. −20% 19%

Normal growth 0.40. 25% 12%

Boom 0.30 30% −9%

Calculate the value of the covariance between the stock and bond funds. (Negative value should be indicated by a minus sign. Do not round intermediate calculations. Round your answer to 2 decimal places.)

Answers: 2

Other questions on the subject: Mathematics

Mathematics, 21.06.2019 13:30, raquelqueengucci25

If δmtv is reflected across the y-axis, what are the resulting coordinates of point m? a) (-2, 5) b) (-5, 2) c) (5, -2) d) (-2, -5)

Answers: 1

Mathematics, 21.06.2019 19:10, dylancasebere

What is the quotient of m^6/5 ÷ 5/m^2? assume m does not equal pl

Answers: 1

Mathematics, 21.06.2019 21:30, gigglegirl5802

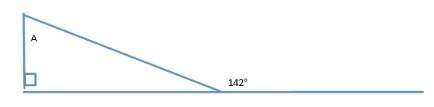

Select all the statements that apply to this figure

Answers: 2

Mathematics, 21.06.2019 23:30, blueval3tine

Sally deposited money into a savings account paying 4% simple interest per year. the first year, she earn $75 in interest. how much interest will she earn during the following year?

Answers: 1

You know the right answer?

Consider the following table:

Scenario Probability Stock Fund Rate of Return Bond FundRate of Retu...

Questions in other subjects:

Biology, 31.01.2020 13:58

Mathematics, 31.01.2020 13:58

French, 31.01.2020 13:58

English, 31.01.2020 13:58