Mathematics, 18.09.2021 19:00 abbymoses3

The Federal Unemployment Tax Act (FUTA) specifies that

an employer pay 6% unemployment tax on the first

$7000 of earned income per employee. If the employer

pays into a state unemployment insurance program,

they will receive a 5.4% credit. The after-credit FUTA tax

rate is therefore 0.6%.

If a business has 25 employees, who each earn more than

$7000 per year in wages, what is the business's yearly

FUTA tax payment?

FUTA tax payment = $ [?]

Round to the nearest hundredth.

Answers: 1

Other questions on the subject: Mathematics

Mathematics, 21.06.2019 15:30, nicpinela1234

The coordinates of a, b, and c in the diagram are a(p,4), b(6,1), and c(9,q). which equation correctly relates p and q? hint: since is perpendicular to , the slope of × the slope of = -1. a. p - q = 7 b. q - p = 7 c. -q - p = 7 d. p + q = 7

Answers: 3

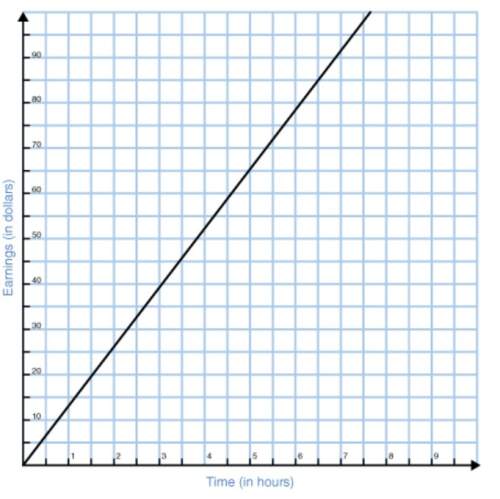

Mathematics, 21.06.2019 16:00, dayanawhite64

Which term best describes the association between variables a and b? no association a negative linear association a positive linear association a nonlinear association a scatterplot with an x axis labeled, variable a from zero to ten in increments of two and the y axis labeled, variable b from zero to one hundred forty in increments of twenty with fifteen points in a positive trend.

Answers: 2

You know the right answer?

The Federal Unemployment Tax Act (FUTA) specifies that

an employer pay 6% unemployment tax on the...

Questions in other subjects:

Mathematics, 16.12.2020 07:00

Health, 16.12.2020 07:00

Biology, 16.12.2020 07:00

Mathematics, 16.12.2020 07:00