Mathematics, 01.08.2021 14:00 angie249

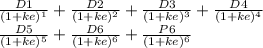

Consider the following three stocks:

a) Stock A is expected to provide a dividend of $10 a share forever.

b) Stock B is expected to pay a dividend of $5 next year. Thereafter, dividend growth is expected to be 4% a year forever.

c) Stock C is expected to pay a dividend of $5 next year. Thereafter, dividend growth is expected to be 20% a year for five years (i. e., until year 6) and zero thereafter. If the market capitalization rate for each stock is 10%, which stock is the most valuable? What if the capitalization rate is 7%?

Answers: 1

Other questions on the subject: Mathematics

Mathematics, 21.06.2019 16:30, sjaybanks4067

Asequence {an} is defined recursively, with a1 = 1, a2 = 2 and, for n > 2, an = an-1 an-2 . find the term a241

Answers: 2

Mathematics, 22.06.2019 03:50, cookiebrain72

Write the equation for the graph with the vertex (-6,2) and focus (-7.25,2) a. (y-2)^2 = -5(x+6) b. (y+6)^2 = -5(x-2) c. (x+6)^2 = -5(y+2) d. (y-6)^2 = 5(x+6)

Answers: 1

Mathematics, 22.06.2019 04:00, ttrinityelyse17

What is the approximate value of the correlation coefficient for the given graph? a. 1 b. 5 c. 3 d. -1

Answers: 2

You know the right answer?

Consider the following three stocks:

a) Stock A is expected to provide a dividend of $10 a share fo...

Questions in other subjects:

Mathematics, 01.04.2021 01:00

Mathematics, 01.04.2021 01:00

Mathematics, 01.04.2021 01:00

Mathematics, 01.04.2021 01:00

History, 01.04.2021 01:00