Mathematics, 18.06.2021 02:30 ritaraum1802

Suppose that it is impractical to use all the assets that are incorporated into a specified portfolio (such as a given efficient portfolio). One alternative is to find the portfolio, made up of a given set of n stocks, that tracks the specified portfolio most closely—in the sense of minimizing the variance of the different returns. Specifically, suppose that the target portfolio has (random) rate of return rM. Suppose that there are n assets with (random) rates of return r1, r2, … rn. We wish to find the portfolio rate of return: r = α1r1+ α2r2 + … + αnrn (with ∑_(i=1)^n▒αI = 1) minimizing var(r - rM) Find a set of equations for the αn’s Although this portfolio tracks the desired portfolio most closely in terms of variance, it may sacrifice the mean. Hence a logical approach is to minimize the variance of the tracking error subject to achieving a given mean return. As the mean is varied, this results in a family of portfolios that are efficient in a new sense, say tracking efficient. Find the equations of the αi’sthat are tracking efficient.

Answers: 2

Other questions on the subject: Mathematics

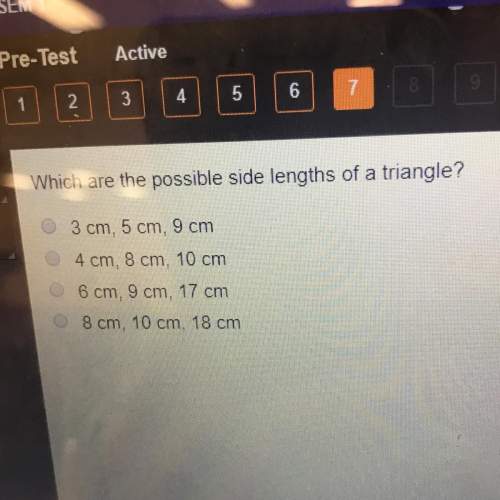

Mathematics, 22.06.2019 01:30, katekayrodriguez10

Solve for the equation x. 2x + 22 = 4(x + 3)

Answers: 1

Mathematics, 22.06.2019 02:10, kinqlouiee2253

Of jk j(–25, 10) k(5, –20). is y- of l, jk a 7: 3 ? –16 –11 –4 –1

Answers: 1

Mathematics, 22.06.2019 04:30, loredohome

Asap easy 6th grade 30 pts describe how to rewrite a power with a positive exponent so that the exponent is in the denominator.

Answers: 1

You know the right answer?

Suppose that it is impractical to use all the assets that are incorporated into a specified portfoli...

Questions in other subjects:

Mathematics, 16.02.2022 03:10

Mathematics, 16.02.2022 03:10

Mathematics, 16.02.2022 03:10

Mathematics, 16.02.2022 03:10

Mathematics, 16.02.2022 03:10

Medicine, 16.02.2022 03:20