Mathematics, 05.05.2021 08:10 WonTonBagel

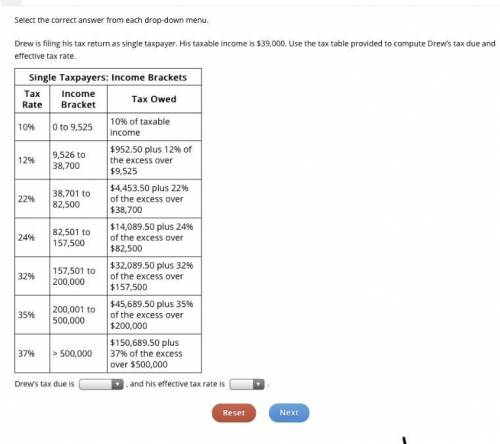

Drew is filing his tax return as single taxpayer. His taxable income is $39,000. Use the tax table provided to compute Drew’s tax due and effective tax rate

Answers: 2

Other questions on the subject: Mathematics

Mathematics, 21.06.2019 20:00, maggiegoodenough62

The holiday party will cost $160 if 8 people attend. if there are 40 people who attend the party, how much will the holiday party cost

Answers: 1

Mathematics, 22.06.2019 01:00, tladitidimatso1783

Match the one-to-one functions with their inverse functions.

Answers: 1

Mathematics, 22.06.2019 02:00, nadinealonzo6121

Identify the percent of change as an increase or a decrease. 75 people to 25 people response - correct increase decrease question 2 find the percent of change. round to the nearest tenth of a percent.

Answers: 3

You know the right answer?

Drew is filing his tax return as single taxpayer. His taxable income is $39,000. Use the tax table p...

Questions in other subjects:

English, 23.10.2019 14:00

Biology, 23.10.2019 14:00

Spanish, 23.10.2019 14:00

History, 23.10.2019 14:00

Biology, 23.10.2019 14:00