Mathematics, 22.04.2021 18:30 briiannamb

Almond inc a registered dealer, purchased a non-current asset from Energise Inc who is a registered dealer, for $20,000

The dealer charged 20% sales tax. The trade discount allowed by the dealers 2.5%

The correct accounting entry recorded in the books for Almond Inc will be..

A. Dr Non current asset $23,400

Cr Energise Inc $23,400

Being goods sold to Energise Inc

B. Dr Non-current asset 20,000

Dr Sales Tax $3,900

Cr Energise Inc $23,400

Cr Trade Discount received

$500

Being goods sold to Energise Inc

C. Dr Non current asset $19,500

Dr Sales Tax $3,900

Cr Energise Inc $23,400

Being goods sold to Energise Inc

D. Dr Non-current asset $20,936

Dr Sales tax $3,900

Cr Energise Inc $23,400

Cr Trade discount receivable $500

Cr Cash discount receivable $936

Being goods sold to Energise Inc

Answers: 2

Other questions on the subject: Mathematics

Mathematics, 21.06.2019 17:30, leannamat2106

43lbs of tomatos cost $387. how much would 41lbs cost

Answers: 1

Mathematics, 21.06.2019 19:30, leilanimontes714

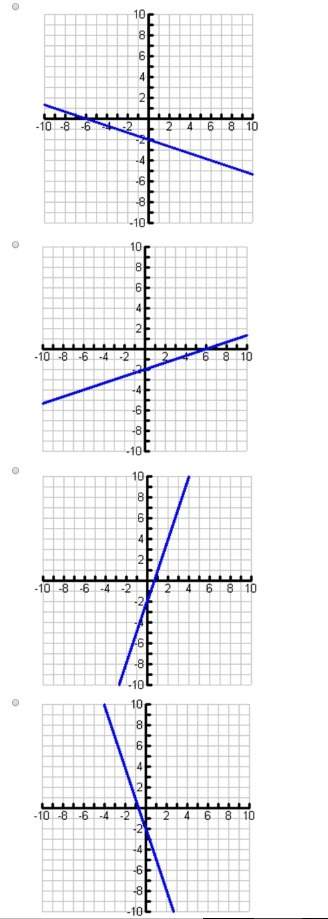

Solve the following simultaneous equation by using an algebraic method (either substitution or elimination) 2x + 3y=-4 4x-y=11

Answers: 1

Mathematics, 21.06.2019 20:30, lcy1086526Lisa1026

25) 56(1) = 5b a. identity property of addition b. identity property of multiplication c. commutative property of multiplication d. commutative property of addition

Answers: 1

You know the right answer?

Almond inc a registered dealer, purchased a non-current asset from Energise Inc who is a registered...

Questions in other subjects:

Biology, 21.10.2019 18:30

Biology, 21.10.2019 18:30

Mathematics, 21.10.2019 18:30