Rachel earned $23,750 and paid a fica tax of 7.65%. how much fica tax did she pay?

a. $18,16...

Mathematics, 28.10.2019 14:31 eshaesmot12345

Rachel earned $23,750 and paid a fica tax of 7.65%. how much fica tax did she pay?

a. $18,168.75 b. $18.17 c. $181.69 d. $1,816.88

maura is a self-employed artist. she averages a monthly income of $2,980. if the fica rate is 15.02%, how much fica tax must she pay each year?

a. $3,576

b. $227.97

c. $2,735.64

d. $5,371.15

maxine is a self-employed writer. she averages a monthly income of $3,250. if the fica rate is 15.02%, how much fica tax must she pay each year?

a. $248.63

b. $2,983.50

c. $5,857.80

d. $39,000

Answers: 3

Other questions on the subject: Mathematics

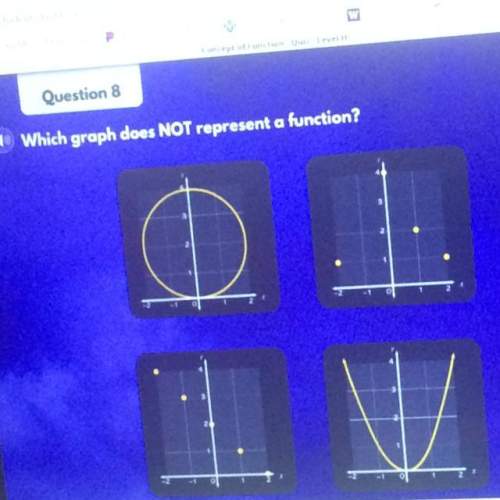

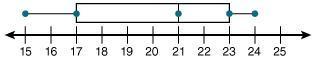

Mathematics, 21.06.2019 17:30, tnassan5715

What is the shape of the height and weight distribution

Answers: 2

Mathematics, 21.06.2019 18:50, firenation18

The table represents a function. what is f(-2)? a.-3 b. -1 c.1 d.3

Answers: 1

Mathematics, 21.06.2019 19:30, viodsenpai

John checked his watch and said that it is thursday, 7 am. what will the day and time be 2006 hours plzzz i will give you 100 points

Answers: 1

You know the right answer?

Questions in other subjects:

History, 07.01.2021 02:20

Mathematics, 07.01.2021 02:20

English, 07.01.2021 02:20

Mathematics, 07.01.2021 02:20

English, 07.01.2021 02:20

Mathematics, 07.01.2021 02:20