Mathematics, 19.04.2021 20:30 beausisugpula

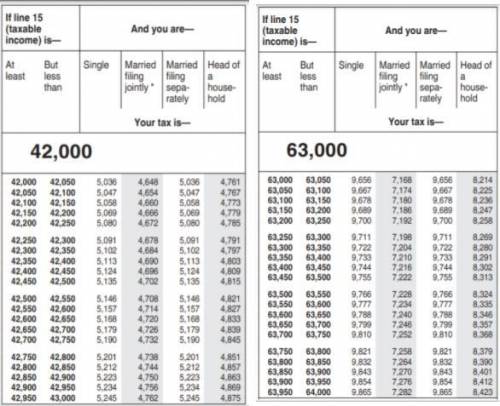

Use the tax tables to determine the tax for the given filing status and taxable income amount:

Head of Household $63,572: $

Single $42,921: $

Married Filing Jointly $42,051: $

Married Filing Separately $63,999: $

Type the numbers with no $ sign and no decimals.

Answers: 1

Other questions on the subject: Mathematics

You know the right answer?

Use the tax tables to determine the tax for the given filing status and taxable income amount:

Head...

Questions in other subjects:

Computers and Technology, 29.07.2021 14:00

English, 29.07.2021 14:00

Social Studies, 29.07.2021 14:00

Mathematics, 29.07.2021 14:00

Computers and Technology, 29.07.2021 14:00

Mathematics, 29.07.2021 14:00

Health, 29.07.2021 14:00