Mathematics, 04.02.2020 22:48 keithaaron3803

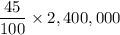

Calculating the estate tax. joel and rachel are both retired. married for 50 years, they’ve amassed an estate worth $2.4 million. the couple has not trusts or other types of tax-sheltered assets. if joel or rachel dies in 2008, how much federal estate tax would the surviving spouse have to pay, assuming that the estate is taxed at the 45 percent rate?

Answers: 1

Other questions on the subject: Mathematics

Mathematics, 21.06.2019 16:30, rleiphart1

If your annual gross income is $62,000 and you have one monthly car payment of $335 and a monthly student loan payment of $225, what is the maximum house payment you can afford. consider a standard 28% front-end ratio and a 36% back-end ratio. also, to complete your calculation, the annual property tax will be $3,600 and the annual homeowner's premium will be $360.

Answers: 1

Mathematics, 21.06.2019 19:30, vanessagallion

Evaluate 3(a + b + c)squared for a = 2, b = 3, and c = 4. a. 54 b. 243 c.729 add solution .

Answers: 1

Mathematics, 21.06.2019 23:40, guadalupemarlene2001

Which set of side lengths form a right side? a) 3ft,6ft,5ft b)50 in,48in,14in c)53m,48m,24m d)8cm,17cm,14cm

Answers: 2

Mathematics, 22.06.2019 00:00, notashley1703

Write the equation in general quadratic form: plz !

Answers: 1

You know the right answer?

Calculating the estate tax. joel and rachel are both retired. married for 50 years, they’ve amassed...

Questions in other subjects:

Mathematics, 13.11.2019 02:31

Mathematics, 13.11.2019 02:31

Mathematics, 13.11.2019 02:31

English, 13.11.2019 02:31

Mathematics, 13.11.2019 02:31