Mathematics, 08.04.2021 20:40 meaghan18

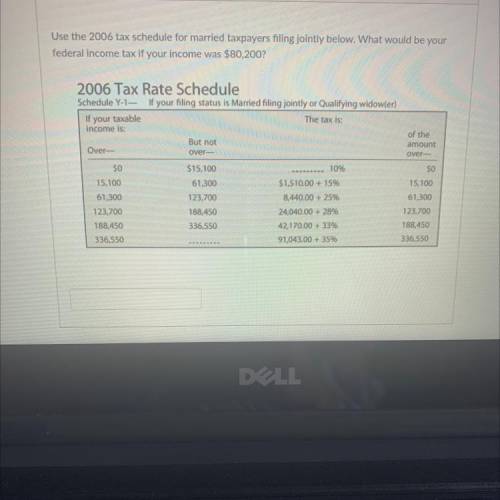

Use the 2006 tax schedule for married taxpayers filing jointly below. What would be your

federal income tax if your income was $80,200?

2006 Tax Rate Schedule

Schedule Y-1- If your filing status is Married filing jointly or Qualifying widow(er)

If your taxable

The tax is:

income is:

But not

Over-

over-

of the

amount

over-

10%

$1,510.00 + 15%

$0

15,100

61,300

123,700

188,450

336,550

$15,100

61,300

123,700

188,450

336,550

8,440.00 + 25%

24,040.00 + 28%

42,170.00 + 33%

91,043.00 + 3596

$0

15,100

61,300

123,700

188,450

336,550

M

Answers: 3

Other questions on the subject: Mathematics

Mathematics, 21.06.2019 18:40, Jonny13Diaz

What is the value of the expression below? 148+(-6)| + |– 35= 7|

Answers: 2

Mathematics, 21.06.2019 19:00, haileysolis5

Arestaurant chef made 1 1/2 jars of pasta sauce. each serving of pasta requires 1/2 of a jar of sauce. how many servings of pasta will the chef be bale to prepare using the sauce?

Answers: 3

Mathematics, 21.06.2019 22:20, KillerSteamcar

Which strategy is used by public health to reduce the incidence of food poisoning?

Answers: 2

You know the right answer?

Use the 2006 tax schedule for married taxpayers filing jointly below. What would be your

federal in...

Questions in other subjects:

Mathematics, 20.06.2020 16:57

Mathematics, 20.06.2020 16:57

Mathematics, 20.06.2020 16:57

Mathematics, 20.06.2020 16:57