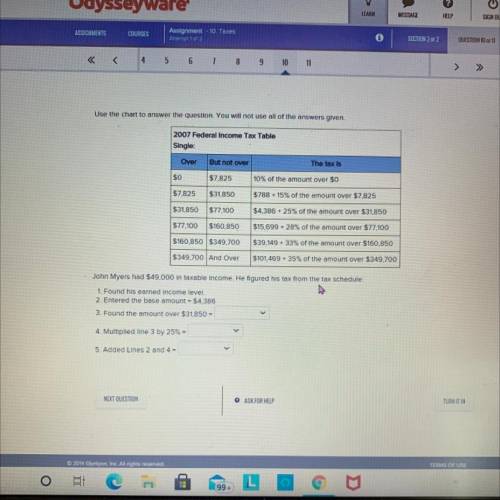

2007 Federal Income Tax Table

Single:

Over

But not over

The tax is

$0

...

Mathematics, 07.04.2021 22:20 nurikchan

2007 Federal Income Tax Table

Single:

Over

But not over

The tax is

$0

$7.825

10% of the amount over $0

$7.825

$31.850

$788 + 15% of the amount over $7,825

$31,850

$77.100

$4,386 + 25% of the amount over $31.850

$77.100

$160.850

$15,699 + 28% of the amount over $77.100

$160.850 $349.700

$39.149 + 33% of the amount over $160,850

$349.700 And Over

$101.469 + 35% of the amount over $349.700

John Myers had $49.000 in taxable income. He figured his tax from the tax schedule:

1. Found his earned Income level.

2. Entered the base amount = $4.386

3. Found the amount over $31.850 =

4. Multiplied line 3 by 25% =

5. Added Lines 2 and 4 =

Answers: 3

Other questions on the subject: Mathematics

Mathematics, 21.06.2019 14:30, robert7248

Is δ pmr similar to δ smn ? if so, which postulate or theorem proves these two triangles are similar?

Answers: 1

Mathematics, 21.06.2019 19:50, twitter505567

How do i simply this expression (quadratic formula basis) on a ti-84 or normal calculator?

Answers: 3

Mathematics, 21.06.2019 23:00, thebrain1345

The price of a car has been reduced from $19,000 to $11,590. what is the percentage decrease of the price of the car?

Answers: 1

You know the right answer?

Questions in other subjects:

Chemistry, 26.01.2021 16:50

Chemistry, 26.01.2021 16:50

Biology, 26.01.2021 16:50

Mathematics, 26.01.2021 16:50

Mathematics, 26.01.2021 16:50

Biology, 26.01.2021 16:50

Mathematics, 26.01.2021 16:50