Mathematics, 30.03.2021 21:30 mawawakaiii

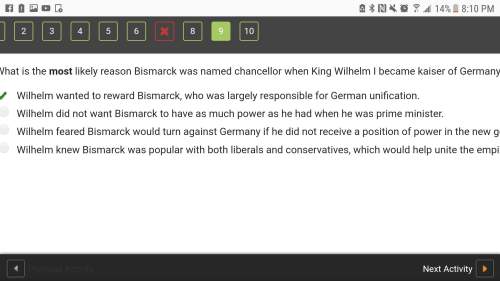

Question 13 of 36

A part-time caregiver made $8944.58 last year. If he claimed himself as an

exemption for $3650 and had a $5700 standard deduction, what was his

taxable income last year?

A. $5294.88

B. $405.42

C. $0

D. $3244.58

SUBMIT

Answers: 1

Other questions on the subject: Mathematics

Mathematics, 20.06.2019 18:02, jadkins842

Give all possible names for each angle shown. calculation tip: in angle abc, b is the vertex.

Answers: 1

Mathematics, 21.06.2019 21:00, jinxjungkook

Two florida panthers were weighed. one weighs 6x+21 pounds and the two together weigh 14x+11 pounds how much does he other panther weigh alone

Answers: 1

Mathematics, 21.06.2019 22:30, kaylaamberd

Maria found the least common multiple of 6 and 15. her work is shown below. multiples of 6: 6, 12, 18, 24, 30, 36, 42, 48, 54, 60, . . multiples of 15: 15, 30, 45, 60, . . the least common multiple is 60. what is maria's error?

Answers: 1

You know the right answer?

Question 13 of 36

A part-time caregiver made $8944.58 last year. If he claimed himself as an

...

...

Questions in other subjects:

Health, 16.07.2019 07:10

Mathematics, 16.07.2019 07:10

Mathematics, 16.07.2019 07:10

Spanish, 16.07.2019 07:10

History, 16.07.2019 07:10

Geography, 16.07.2019 07:10

Mathematics, 16.07.2019 07:10