Mathematics, 11.03.2021 01:00 Hammon1774

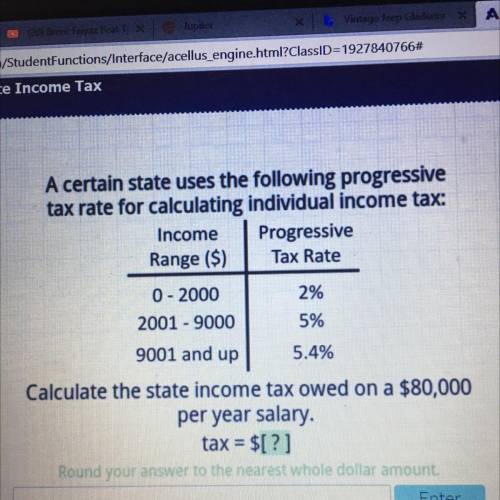

A certain state uses the following progressive

tax rate for calculating individual income tax:

Income Progressive

Range ($) Tax Rate

0 - 2000

2%

2001 - 9000 5%

9001 and up

5.4%

Calculate the state income tax owed on a $80,000

per year salary.

tax = $[?]

Round your answer to the nearest whole dollar amount.

Answers: 1

Other questions on the subject: Mathematics

Mathematics, 21.06.2019 18:30, nikidastevens36

Idon’t understand! use slope intercept form to solve: through: (2,5) slope= undefined

Answers: 1

Mathematics, 21.06.2019 18:40, icantspeakengles

Does the point (1, sqrt 7) lie on circle shown.

Answers: 1

Mathematics, 21.06.2019 20:30, jonmorton159

Aword processing program requires a 7- digit registration code made up of the digits 1,2,4,5,6,7 and 9 each number has to be used and no number can be used mor than once how many codes are possible

Answers: 1

Mathematics, 21.06.2019 23:00, kealalac1

Afunction, f(x), represents the height of a plant x months after being planted. students measure and record the height on a monthly basis. select the appropriate domain for this situation. a. the set of all positive real numbers b. the set of all integers oc. the set of all positive integers od. the set of all real numbers reset next

Answers: 3

You know the right answer?

A certain state uses the following progressive

tax rate for calculating individual income tax:

Questions in other subjects:

Chemistry, 25.07.2021 17:20

Mathematics, 25.07.2021 17:20

Mathematics, 25.07.2021 17:30

Social Studies, 25.07.2021 17:30

Computers and Technology, 25.07.2021 17:30