Mathematics, 08.02.2021 02:50 notchasedeibel6575

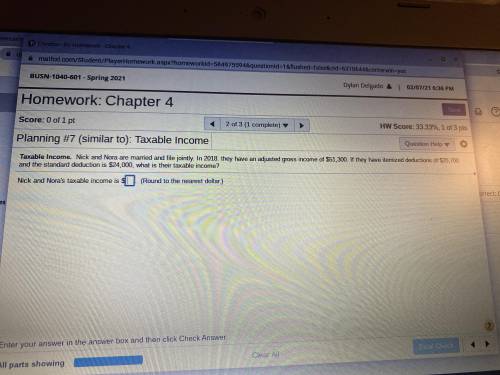

Nick and Nora are married and have three children in college. They have an adjusted gross income of $47,400. If their standard deduction is $12,600, itemized deductions are $14,200, and they get an exemption of $4,000 for each adult and each dependent, what is their taxable income?

Answers: 1

Other questions on the subject: Mathematics

Mathematics, 21.06.2019 22:30, raquelqueengucci25

What is the distance from zero if a quadratic function has a line of symmetry at x=-3 and a zero at 4

Answers: 1

Mathematics, 22.06.2019 01:00, franklinkaylieg3873

What are the solutions for the following system? -2x^2+y=-5 y=-3x^2+5

Answers: 3

Mathematics, 22.06.2019 01:30, bellaforlife9

Amayoral candidate would like to know her residents’ views on a tax on sugar drinks before the mayoral debates. she asks one thousand registered voters from both parties. these voters are an example of a census population convenience sample simple random sample

Answers: 1

You know the right answer?

Nick and Nora are married and have three children in college. They have an adjusted gross income of...

Questions in other subjects:

History, 25.03.2020 17:40

Mathematics, 25.03.2020 17:40

Biology, 25.03.2020 17:40