Mathematics, 04.12.2020 23:30 bvallinab

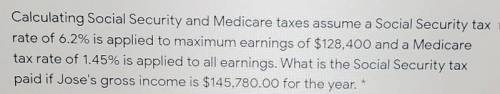

Calculating Social Security and Medicare taxes assume a Social Security tax rate of 6.2% is applied to maximum earnings of $128.400 and a Medicare tax rate of 1.45% is applied to all earnings. What is the Social Security tax paid if Jose's gross income is $145,780.00 for the year. i dont know what to do someone please help

Answers: 3

Other questions on the subject: Mathematics

Mathematics, 21.06.2019 14:30, snoodledoodlebop

anyone? find the second, fifth, and ninth terms of a sequence where the first term is 65 and the common difference is -7. 72, 93, 121 72, 79, 86 58, 37, 9 58, 51, 44

Answers: 1

Mathematics, 21.06.2019 21:50, jules8022

Match each whole number with a rational, exponential expression 3 square root 27^2find the domain and range of the exponential function h(x)=125^x. explain your findings. as x decreases does h increase or decrease? explain. as x increases does h increase or decrease? explain.

Answers: 3

Mathematics, 21.06.2019 22:00, breannaasmith1122

Mr. walker is looking at the fundraiser totals for the last five years , how does the mean of the totals compare to the median?

Answers: 1

Mathematics, 22.06.2019 00:30, nssjdjsididiodododod

On the way home from visiting his family, vincent’s plane cruised at an altitude of 3.2 × 10^4 feet. he had heard that a man named felix baumgartner skydived from an altitude of 1.28 × 10^5 feet. vincent wants to know how much higher felix went on his skydiving trip. question 1 you have already seen how adding numbers works in either scientific notation or standard notation. but can you subtract numbers in scientific notation and get the same results as subtracting in standard notation? to find out, first solve vincent’s problem in standard notation. part a write the cruising altitude of vincent’s plane in standard notation.

Answers: 2

You know the right answer?

Calculating Social Security and Medicare taxes assume a Social Security tax rate of 6.2% is applied...

Questions in other subjects:

English, 22.08.2019 10:20

Social Studies, 22.08.2019 10:20