Mathematics, 13.11.2020 07:30 Isabe11a

Equipment acquired at a cost of $105,000 has an estimated residual value of $12,000 and an estimated useful life of 10 years. It was placed into service on May 1 of the current fiscal year, which ends on December 31.

a. Determine the depreciation for the current fiscal year and for the following fiscal year by the straight-line method.

Depreciation

Year 1$6200

Year 2$9,300

b. Determine the depreciation for the current fiscal year and for the following fiscal year by the double-declining-balance method.

Depreciation

Year 1$ ?

Year 2$ ?

Answers: 2

Other questions on the subject: Mathematics

Mathematics, 21.06.2019 22:30, xandraeden32

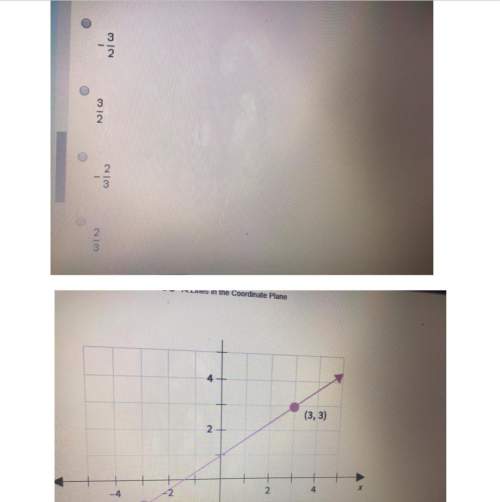

Ingredient c: 1/4 cup for 2/3 serving or ingredient d: 1/3 cup for 3/4 serving which unit rate is smaller

Answers: 2

You know the right answer?

Equipment acquired at a cost of $105,000 has an estimated residual value of $12,000 and an estimated...

Questions in other subjects:

Mathematics, 05.05.2020 15:14

Biology, 05.05.2020 15:14

Mathematics, 05.05.2020 15:14

Mathematics, 05.05.2020 15:14