Julie Bookwalter.

Earns $32,300 annually.

Single, 1 dependent.

State tax rate is 2.5 pe...

Mathematics, 09.11.2020 21:20 grales65

Julie Bookwalter.

Earns $32,300 annually.

Single, 1 dependent.

State tax rate is 2.5 percent.

a. What are her personal exemptions?

b. What is withheld for state tax?

Please Help I been stuck on this one forever.

Answers: 1

Other questions on the subject: Mathematics

Mathematics, 21.06.2019 15:40, helper4282

The number of lattes sold daily for two coffee shops is shown in the table: lattes 12 52 57 33 51 15 46 45 based on the data, what is the difference between the median of the data, including the possible outlier(s) and excluding the possible outlier(s)? 48.5 23 8.4 3

Answers: 3

Mathematics, 21.06.2019 17:30, sabrinarasull1pe6s61

Find the zero function by factoring (try to show work) h(x)=-x^2-6x-9

Answers: 2

You know the right answer?

Questions in other subjects:

English, 15.02.2021 19:10

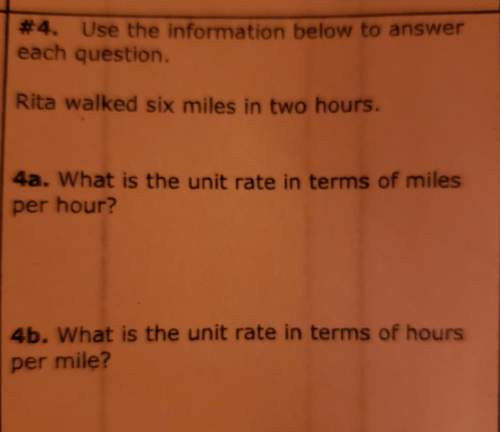

Mathematics, 15.02.2021 19:10

History, 15.02.2021 19:10

Mathematics, 15.02.2021 19:10

Mathematics, 15.02.2021 19:10

Mathematics, 15.02.2021 19:10