Mathematics, 25.10.2020 14:00 destmacklin

Raquel has gross pay of $732 and federal tax withholdings of $62. Determine Raquel’s net pay if she has the additional items withheld: Social Security tax that is 6.2% of her gross pay Medicare tax that is 1.45% of her gross pay state tax that is 21% of her federal tax a. $600.99 b. $610.54 c. $641.83 d. $662.99

Answers: 3

Other questions on the subject: Mathematics

Mathematics, 21.06.2019 14:20, glocurlsprinces

At his new job, jeremiah can choose an hourly rate of $9 plus a $50 weekly bonus for opening the store, or an hourly rate of $10 per hour with no opening bonus. the equations model his salary options. y = 9x + 50 y = 10x

Answers: 2

Mathematics, 21.06.2019 19:00, ashrobbb

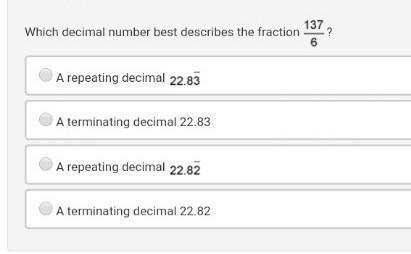

The annual snowfall in a town has a mean of 38 inches and a standard deviation of 10 inches. last year there were 63 inches of snow. find the number of standard deviations from the mean that is, rounded to two decimal places. 0.44 standard deviations below the mean 2.50 standard deviations below the mean 0.44 standard deviations above the mean 2.50 standard deviations above the mean

Answers: 3

Mathematics, 22.06.2019 00:30, brianlykid3042

Graph a point. start at your origin, move left 10 units, and then move up three units which ordered pair is the point you graphed

Answers: 2

You know the right answer?

Raquel has gross pay of $732 and federal tax withholdings of $62. Determine Raquel’s net pay if she...

Questions in other subjects:

Mathematics, 04.02.2021 17:10

Mathematics, 04.02.2021 17:10

Mathematics, 04.02.2021 17:10

History, 04.02.2021 17:10

English, 04.02.2021 17:10