PLEASE HELP!!

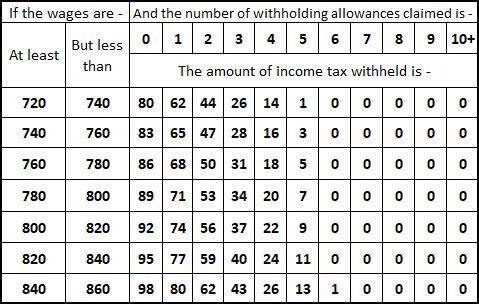

The following federal tax table is for biweekly earnings of a single person.

A...

Mathematics, 23.10.2020 02:01 ninigilford

PLEASE HELP!!

The following federal tax table is for biweekly earnings of a single person.

A single person earns a gross biweekly salary of $780 and claims 6 exemptions. How does their net pay change due to the federal income tax withheld?

a.

No federal income taxes are withheld.

b.

They will add $11 to their gross pay.

c.

They will subtract $11 from their gross pay.

d.

They will add $13 to their gross pay.

Answers: 1

Other questions on the subject: Mathematics

Mathematics, 21.06.2019 15:00, angie07253

Brady has a 20 year fixed rate mortgage for $215,500 with monthly payments of 1,305.89.the annual interest rate is 4%. what is the total cost of the principal and interest for this loan rounded to the nearest dollar

Answers: 3

Mathematics, 21.06.2019 16:40, idioticeinstein9021

How do i get my dad to stop making me gargle his pickle i want my mom to gargle my pickle not my dads

Answers: 3

Mathematics, 21.06.2019 22:10, karinagramirezp072gb

2. using calculations based on a perpetual inventory system, determine the inventory balance altira would report in its august 31, 2021, balance sheet and the cost of goods sold it would report in its august 2021 income statement using the average cost method. (round "average cost per unit" to 2 decimal places.)

Answers: 1

You know the right answer?

Questions in other subjects:

Chemistry, 10.06.2021 19:50

Mathematics, 10.06.2021 19:50

Mathematics, 10.06.2021 19:50

Mathematics, 10.06.2021 19:50