Mathematics, 21.10.2020 14:01 Homepage10

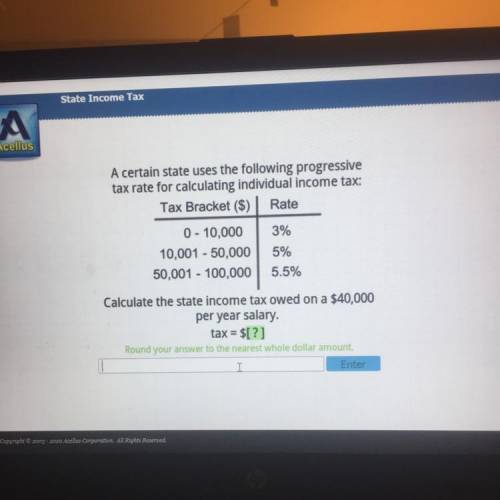

A certain state uses the following progressive

tax rate for calculating individual income tax:

Tax Bracket ($) Rate

3%

0 - 10,000

10,001 - 50,000

50,001 - 100,000

5%

5.5%

Calculate the state income tax owed on a $40,000

per year salary.

tax = $1?1

Answers: 3

Other questions on the subject: Mathematics

Mathematics, 21.06.2019 20:30, amyaacrawford86

Solve each quadratic equation by factoring and using the zero product property. 14x - 49 = x^2

Answers: 2

Mathematics, 22.06.2019 05:00, zdwilliams1308

Me because i don't understand how to do it.: )

Answers: 1

You know the right answer?

A certain state uses the following progressive

tax rate for calculating individual income tax:

Questions in other subjects:

Mathematics, 03.07.2020 19:01

Mathematics, 03.07.2020 19:01

History, 03.07.2020 19:01