Mathematics, 19.10.2020 14:01 carethegymnast8954

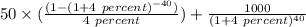

Cox Media Corporation pays a 10 percent coupon rate on debentures that are due in 20 years. The current yield to maturity on bonds of similar risk is 8 percent. The bonds are currently callable at $1,150. The theoretical value of the bonds will be equal to the present value of the expected cash flow from the bonds. Use Appendix B and Appendix D for an approximate answer but calculate your final answer using the formula and financial calculator methods.

Answers: 1

Other questions on the subject: Mathematics

Mathematics, 21.06.2019 16:10, cthompson1107

Which expression gives the area of the triangle shown below

Answers: 1

Mathematics, 22.06.2019 02:00, saeedalr366

Your company will replace the asphalt roofs on all the buildings at the factory complex shown below. the buildings have flat roofs. you charge according to the total roof area. what is this area, in square yards?

Answers: 3

Mathematics, 22.06.2019 02:10, genyjoannerubiera

The key on a road map has a scale factor of 1.5 inches = 50 miles. the distance between santa fe and albuquerque measures 7.5 inches. the distance between santa fe and taos is 0.75 inches. what is the actual distance between the cities?

Answers: 3

Mathematics, 22.06.2019 04:00, thebrain1345

Aculinary club earns $1360 from a dinner service. they sold 45 adult meals and 80 student meals. an adult meal costs twice as much as a student meal. what is the cost of an adult meal?

Answers: 2

You know the right answer?

Cox Media Corporation pays a 10 percent coupon rate on debentures that are due in 20 years. The curr...

Questions in other subjects:

Spanish, 23.07.2019 23:00

History, 23.07.2019 23:00

Social Studies, 23.07.2019 23:00

Mathematics, 23.07.2019 23:00

Social Studies, 23.07.2019 23:00

History, 23.07.2019 23:00