Mathematics, 18.10.2020 09:01 bglosson4333

Guy is self employed. In one year, Guy generates a gross income of $44, 500. When calculating his taxes, Guy is allowed to

deduct $2,500 in expenses from his gross income the result is his operating income'), Guy must then pay 10% tax on all

operating income up to $20,000 and then 20% on any operating income over $20,000. Calculate the amount of tax that

Guy must pay. Give your answer in dollars to the nearest dollar. Do not include commas or the dollar symbol in your

answer.

Answers: 2

Other questions on the subject: Mathematics

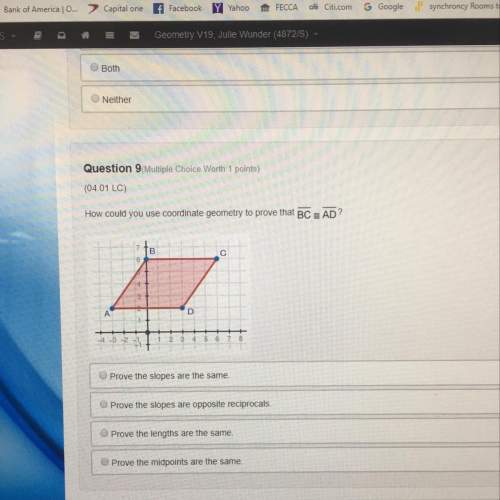

Mathematics, 21.06.2019 15:30, lberman2005p77lfi

Answer question above and explain each step : )

Answers: 3

Mathematics, 21.06.2019 18:30, mikey8510

The median of a data set is the measure of center that is found by adding the data values and dividing the total by the number of data values that is the value that occurs with the greatest frequency that is the value midway between the maximum and minimum values in the original data set that is the middle value when the original data values are arranged in order of increasing (or decreasing) magnitude

Answers: 3

Mathematics, 21.06.2019 22:00, shantejahtierr63961

You're locked out of your house. the only open window is on the second floor, 25 feet above the ground. there are bushes along the edge of the house, so you will need to place the ladder 10 feet from the house. what length ladder do you need to reach the window?

Answers: 3

You know the right answer?

Guy is self employed. In one year, Guy generates a gross income of $44, 500. When calculating his ta...

Questions in other subjects:

History, 16.06.2021 01:00

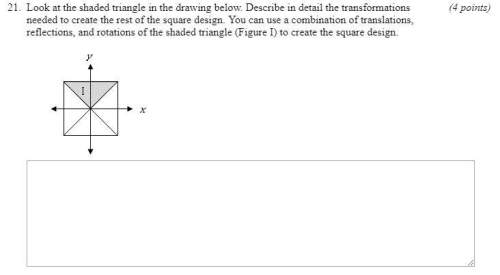

Mathematics, 16.06.2021 01:00

Arts, 16.06.2021 01:00

Mathematics, 16.06.2021 01:00

Chemistry, 16.06.2021 01:00

Mathematics, 16.06.2021 01:00

Health, 16.06.2021 01:00