Mathematics, 05.09.2020 19:01 F00Dislife

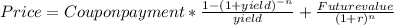

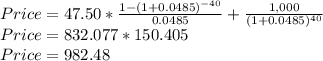

. Assume that you are considering the purchase of a 20-year, noncallable bond with an annual coupon rate of 9.5%. The bond has a face value of $1,000, and it makes semiannual interest payments. If you require an 10.7% nominal yield to maturity on this investment, what is the maximum price you should be willing to pay for the bond?

Answers: 3

Other questions on the subject: Mathematics

Mathematics, 21.06.2019 14:30, purpletart41

Arrange these numbers from least to greatest 3/5 5/7 2/9

Answers: 2

Mathematics, 21.06.2019 22:30, 1930isainunez

How can constraints be used to model a real-world situation?

Answers: 1

You know the right answer?

. Assume that you are considering the purchase of a 20-year, noncallable bond with an annual coupon...

Questions in other subjects:

Mathematics, 21.07.2019 12:30

History, 21.07.2019 12:30