Mathematics, 15.07.2020 15:01 mattmore0312

Eric works for salary of $3,500 per month. He has federal income withheld at the rate of 15%, Social Security tax at the rate of 6.2%, Medicare tax at the rate of 1.45% and health insurance premiums of $48 per month. Erik also contributes to a savings plan. Each month, 2% of his gross pay is placed in the savings plan.

After Erik pays the taxes on his money what is Eric's net pay?

A. (1,448.45)

B. (1,799.05)

C. (2,589.25)

D. (2799.05)

Answers: 2

Other questions on the subject: Mathematics

Mathematics, 21.06.2019 20:00, ellemarshall13

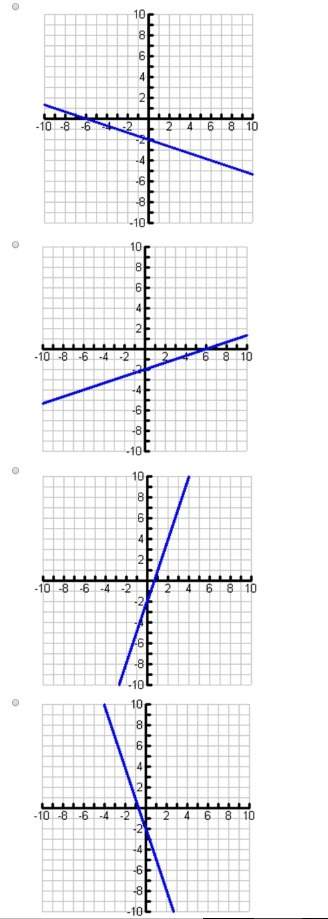

15 there is a line that includes the point 0,10 and has a slope of 7/4. what is it’s equation in slope intercept form

Answers: 1

Mathematics, 21.06.2019 21:30, izabelllreyes

Look at triangle wxy what is the length (in centimeters) of the side wy of the triangle?

Answers: 2

You know the right answer?

Eric works for salary of $3,500 per month. He has federal income withheld at the rate of 15%, Social...

Questions in other subjects:

Mathematics, 27.02.2021 21:50

Mathematics, 27.02.2021 21:50

Mathematics, 27.02.2021 21:50

Arts, 27.02.2021 21:50