Mathematics, 09.06.2020 11:57 RandomLollipop

HELP

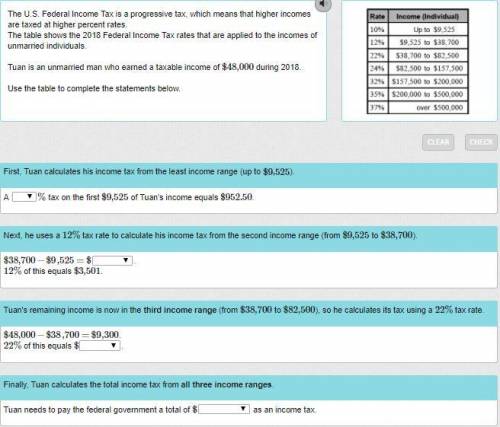

The U. S. Federal Income Tax is a progressive tax, which means that higher incomes are taxed at higher percent rates.

The table shows the 2018 Federal Income Tax rates that are applied to the incomes of unmarried individuals.

Tuan is an unmarried man who earned a taxable income of $48$48,000000 during 2018.

Use the table to complete the statements below.

Answers: 1

Other questions on the subject: Mathematics

Mathematics, 21.06.2019 16:00, johnnny7495

What were mkh company's cash flows from (for) operating activities in 20x1? $(180,300) $233,100 $268,200 $279,400?

Answers: 2

Mathematics, 21.06.2019 20:30, phillipfruge3

East black horse $0.25 total budget is $555 it'll cost $115 for other supplies about how many flyers do you think we can buy

Answers: 1

Mathematics, 22.06.2019 00:30, brianlykid3042

Graph a point. start at your origin, move left 10 units, and then move up three units which ordered pair is the point you graphed

Answers: 2

You know the right answer?

HELP

The U. S. Federal Income Tax is a progressive tax, which means that higher incomes are taxed a...

Questions in other subjects:

Biology, 24.03.2021 01:30

Mathematics, 24.03.2021 01:30

Mathematics, 24.03.2021 01:30

English, 24.03.2021 01:30

Mathematics, 24.03.2021 01:30