Mathematics, 12.04.2020 14:18 sarinawhitaker

SIROM Scientific Solutions has $5 million of outstanding equity and $5 million of bank debt. The bank debt costs 4% per year. The estimated equity beta is 2. If the market risk premium is 8% and the risk-free rate is 4%, compute the weighted average cost of capital if the firm's tax rate is 35%.

Answers: 2

Other questions on the subject: Mathematics

Mathematics, 21.06.2019 17:30, Misspaige5150

17 in long 1.3 ft wide and 8in high what is the volume

Answers: 1

Mathematics, 21.06.2019 18:10, heavenwagner

which of the following sets of data would produce the largest value for an independent-measures t statistic? the two sample means are 10 and 20 with variances of 20 and 25 the two sample means are 10 and 20 with variances of 120 and 125 the two sample means are 10 and 12 with sample variances of 20 and 25 the two sample means are 10 and 12 with variances of 120 and 125

Answers: 2

Mathematics, 21.06.2019 21:30, emilyplays474

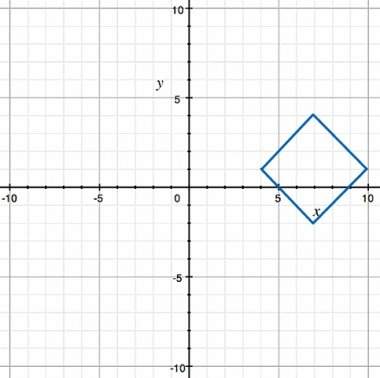

Which of the following is a solution of z^6 = 64i? 2(cos105° + isin105°) 2(cos120° + isin120°) 2(cos135° + isin135°) 8(cos15° + isin15°)

Answers: 1

You know the right answer?

SIROM Scientific Solutions has $5 million of outstanding equity and $5 million of bank debt. The ban...

Questions in other subjects:

Mathematics, 21.12.2020 17:30

English, 21.12.2020 17:30

History, 21.12.2020 17:30

Social Studies, 21.12.2020 17:30