Mathematics, 02.04.2020 02:58 S28462182

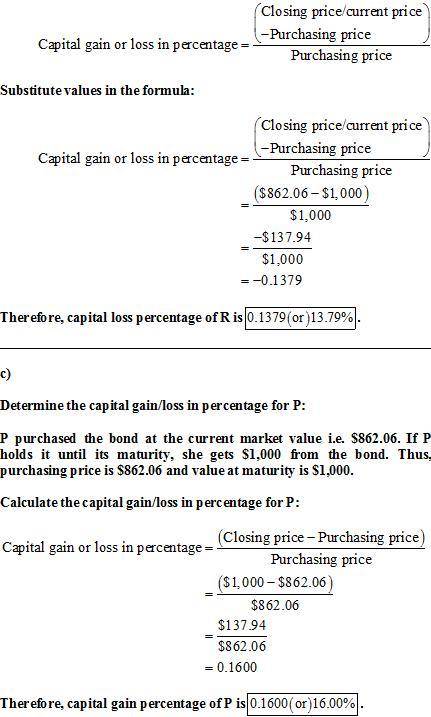

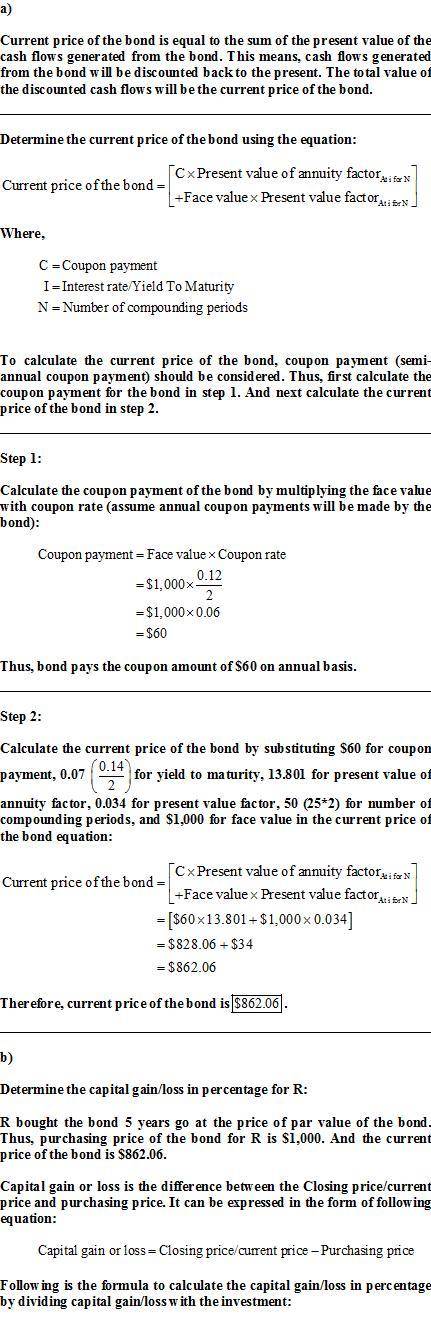

A $1,000 par value bond was issued five years ago at a 12 percent coupon rate. It currently has 25 years remaining to maturity. Interest rates on similar debt obligations are now 14 percent. Use Appendix B and Appendix D for an approximate answer but calculate your final answer using the formula and financial calculator methods.

Answers: 2

Other questions on the subject: Mathematics

Mathematics, 21.06.2019 19:30, TheViperMlg23676

When 142 is added to a number the result is 64 more times the number my options are 35 37 39 41

Answers: 1

Mathematics, 21.06.2019 22:30, minnahelhoor

How do i find the missing angle measure in a polygon

Answers: 1

Mathematics, 21.06.2019 23:00, kierafisher05

Acaterpillar eats 1400\%1400% of its birth mass in one day. the caterpillar's birth mass is mm grams. which of the following expressions could represent the amount, in grams, the caterpillar eats in one day? \

Answers: 1

You know the right answer?

A $1,000 par value bond was issued five years ago at a 12 percent coupon rate. It currently has 25 y...

Questions in other subjects:

Mathematics, 10.03.2020 23:05

History, 10.03.2020 23:05

Mathematics, 10.03.2020 23:05

Mathematics, 10.03.2020 23:06

Mathematics, 10.03.2020 23:06

Social Studies, 10.03.2020 23:06