5. Problem 8.06 (Expected Returns)

eBook Problem Walk-Through

Stocks A and B have...

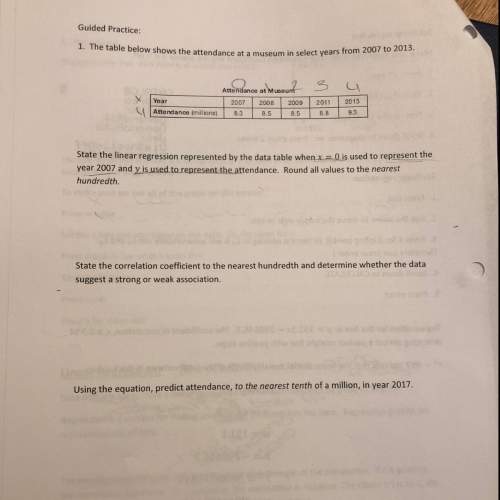

Mathematics, 27.03.2020 22:19 jennifercastill3

5. Problem 8.06 (Expected Returns)

eBook Problem Walk-Through

Stocks A and B have the following probability distributions of expected future returns:

Probability A B

0.1 (13 %) (39 %)

0.2 3 0

0.4 12 20

0.2 19 27

0.1 36 38

Calculate the expected rate of return, , for Stock B ( = 11.50%.) Do not round intermediate calculations. Round your answer to two decimal places.

%

Calculate the standard deviation of expected returns, σA, for Stock A (σB = 20.63%.) Do not round intermediate calculations. Round your answer to two decimal places.

%

Now calculate the coefficient of variation for Stock B. Do not round intermediate calculations. Round your answer to two decimal places.

Is it possible that most investors might regard Stock B as being less risky than Stock A?

If Stock B is more highly correlated with the market than A, then it might have a lower beta than Stock A, and hence be less risky in a portfolio sense.

If Stock B is more highly correlated with the market than A, then it might have the same beta as Stock A, and hence be just as risky in a portfolio sense.

If Stock B is less highly correlated with the market than A, then it might have a lower beta than Stock A, and hence be less risky in a portfolio sense.

If Stock B is less highly correlated with the market than A, then it might have a higher beta than Stock A, and hence be more risky in a portfolio sense.

If Stock B is more highly correlated with the market than A, then it might have a higher beta than Stock A, and hence be less risky in a portfolio sense.

Assume the risk-free rate is 3.5%. What are the Sharpe ratios for Stocks A and B? Do not round intermediate calculations. Round your answers to four decimal places.

Stock A:

Stock B:

Are these calculations consistent with the information obtained from the coefficient of variation calculations in Part b?

In a stand-alone risk sense A is more risky than B. If Stock B is less highly correlated with the market than A, then it might have a lower beta than Stock A, and hence be less risky in a portfolio sense.

In a stand-alone risk sense A is more risky than B. If Stock B is less highly correlated with the market than A, then it might have a higher beta than Stock A, and hence be more risky in a portfolio sense.

In a stand-alone risk sense A is less risky than B. If Stock B is more highly correlated with the market than A, then it might have the same beta as Stock A, and hence be just as risky in a portfolio sense.

In a stand-alone risk sense A is less risky than B. If Stock B is less highly correlated with the market than A, then it might have a lower beta than Stock A, and hence be less risky in a portfolio sense.

In a stand-alone risk sense A is less risky than B. If Stock B is less highly correlated with the market than A, then it might have a higher beta than Stock A, and hence be more risky in a portfolio sense.

Answers: 2

Other questions on the subject: Mathematics

Mathematics, 21.06.2019 14:40, kingteron6166

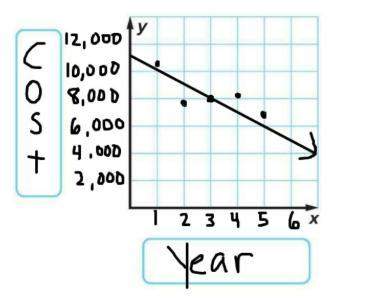

Which system of linear inequalities is represented by the graph? !

Answers: 1

Mathematics, 21.06.2019 19:30, sotoamerica0814

What is the effect on the graph of the function f(x)=x when f(x) is replaced with -f(x)+4

Answers: 1

Mathematics, 21.06.2019 20:00, gracieorman4

Solve each equation using the quadratic formula. find the exact solutions. 6n^2 + 4n - 11

Answers: 2

Mathematics, 21.06.2019 20:30, kcarstensen59070

Solve each quadratic equation by factoring and using the zero product property. 10x + 6 = -2x^2 -2

Answers: 2

You know the right answer?

Questions in other subjects:

Arts, 23.09.2019 00:10

Mathematics, 23.09.2019 00:10

Mathematics, 23.09.2019 00:10