Mathematics, 19.03.2020 02:28 jacks0292

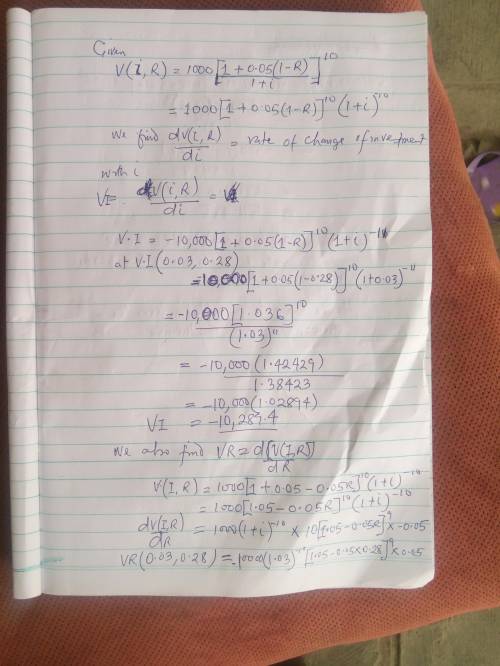

The value of an investment of $1000 earning 5% compounded annually is V(I, R) = 1000 1 + 0.05(1 − R) 1 + I^10 where I is the annual rate of inflation and R is the tax rate for the person making the investment.

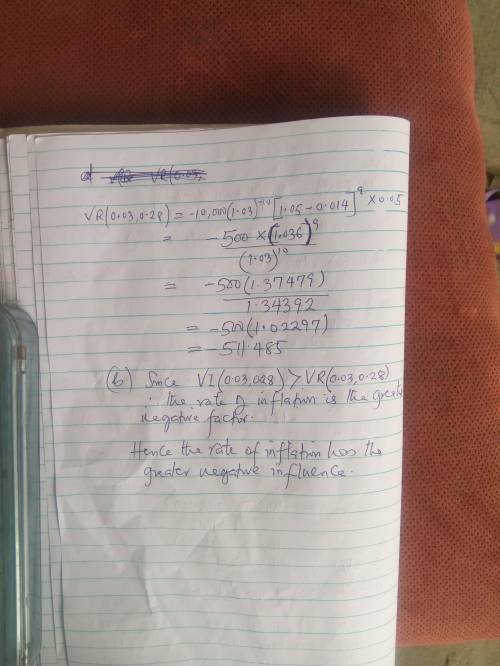

a. Calculate VI(0.03, 0.28) and VR(0.03, 0.28).

b. Determine whether the tax rate or the rate of inflation is the greater "negative" factor in the growth of the investment.

i. The rate of inflation has the greater negative influence.

ii. The tax rate has the greater negative influence

Answers: 2

Other questions on the subject: Mathematics

Mathematics, 21.06.2019 20:30, ciannajustine

Drag the tiles to the correct boxes to complete the pairs. not all tiles will be used. match each division expression with the correct quotient.

Answers: 2

Mathematics, 21.06.2019 21:00, alexahrnandez4678

Dean and karlene get paid to write songs. dean is paid a one-time fee of $20 plus $80 per day. karlene is paid a one-time fee of $25 plus $100 per day. write an expression to represent how much a producer will pay to hire both to work the same number of days on a song.

Answers: 1

You know the right answer?

The value of an investment of $1000 earning 5% compounded annually is V(I, R) = 1000 1 + 0.05(1 − R)...

Questions in other subjects:

Mathematics, 20.02.2020 22:26

English, 20.02.2020 22:26