Mathematics, 06.03.2020 05:54 g0606997

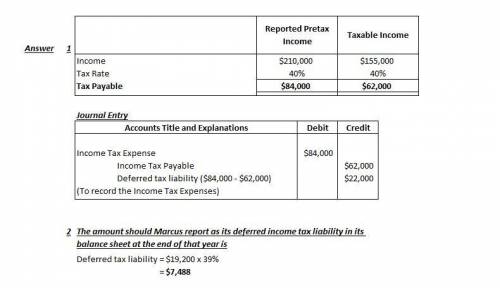

For its first year of operations, Marcus Corporation reported pretax accounting income of $274,800. However, because of a temporary difference in the amount of $19,200 relating to depreciation, taxable income is only $255,600. The tax rate is 39%. What amount should Marcus report as its deferred income tax liability in its balance sheet at the end of that year

Answers: 2

Other questions on the subject: Mathematics

Mathematics, 20.06.2019 18:02, JunoJackson

If angle ywz = 17, what is angle wxy? ok so i'm confused on this because the triangles are congruent so that means they have the same measurement which would make wxy=17, but don't all triangles have total measures of 180 degress? ?me.

Answers: 1

Mathematics, 21.06.2019 20:00, paulesparsa6

Given the two similar triangles, how do i find the missing length? if a=4, b=5, and b'=7.5 find a'

Answers: 1

You know the right answer?

For its first year of operations, Marcus Corporation reported pretax accounting income of $274,800....

Questions in other subjects:

Mathematics, 07.07.2019 11:00

English, 07.07.2019 11:00

Biology, 07.07.2019 11:00

Spanish, 07.07.2019 11:00