Mathematics, 28.02.2020 20:16 julielebo8

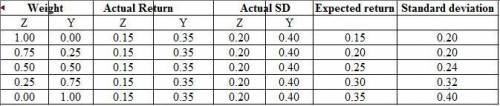

The expected returns and standard deviation of returns for two securities are as follows: Security Z Security Y Expected Return 15% 35% Standard Deviation 20% 40% The correlation between the returns is .25. (a) Calculate the expected return and standard deviation for the following portfolios: i. all in Z ii. .75 in Z and .25 in Y iii. .5 in Z and .5 in Y iv. .25 in Z and .75 in Y

Answers: 2

Other questions on the subject: Mathematics

Mathematics, 21.06.2019 17:30, neverfnmind

James adds two numbers a + b. sally adds the same two numbers but reverse the order b + a what property of addition assures us that james and sally will get the same sum

Answers: 2

Mathematics, 21.06.2019 18:30, myohmyohmy

Nick has box brads. he uses 4 brads for the first project. nick let’s b represent the original number of brads and finds that for the second project, the number of brads he uses is 8 more than half the difference of b and 4. write an expression to represent the number of brads he uses for the second project.

Answers: 3

Mathematics, 21.06.2019 18:50, beeboppity

7. the area of the playing surface at the olympic stadium in beijing isof a hectare. what area will it occupy on a plan drawn to a scaleof 1: 500?

Answers: 3

Mathematics, 21.06.2019 20:10, Maddi7328

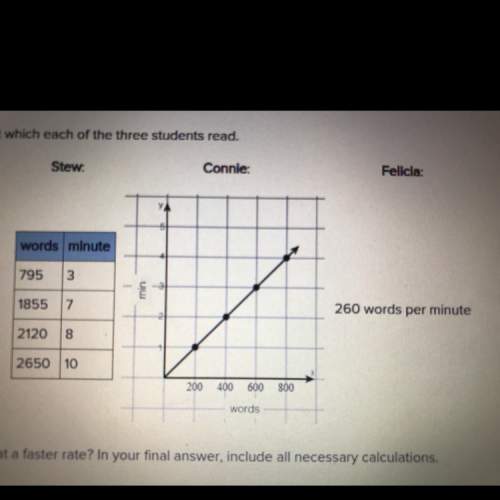

The graph and table shows the relationship between y, the number of words jean has typed for her essay and x, the number of minutes she has been typing on the computer. according to the line of best fit, about how many words will jean have typed when she completes 60 minutes of typing? 2,500 2,750 3,000 3,250

Answers: 1

You know the right answer?

The expected returns and standard deviation of returns for two securities are as follows: Security Z...

Questions in other subjects:

Mathematics, 14.02.2020 06:18

Mathematics, 14.02.2020 06:18

![E (return) = [W(Z)\times E(Z)]+[W(Y)\times E(Y)]](/tpl/images/0528/3761/aa45c.png)