Mathematics, 21.12.2019 07:31 zhenhe3423

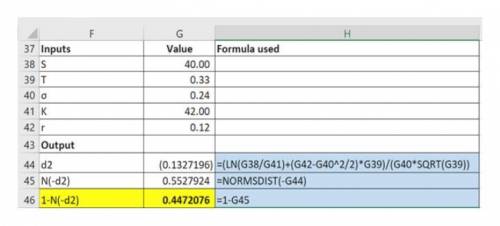

The price of a certain security follows a geometric brownian motion with drift parameter µ = 0.12 and the volatility parameter σ = 0.24.

(a) if the current price of the security is $40, find the probability that a call option, having four months until expiration and with a strike price of k = 42 will be exercised.

(b) in addition to the above information as in part (a) if the interest rate is 8%, find the risk-neutral arbitrage free valuation of the call option.

Answers: 2

Other questions on the subject: Mathematics

Mathematics, 21.06.2019 20:00, ElizabethF

Aball is dropped from a height of 10m above the ground. it bounce to 90% of its previous height on each bounce. what is the approximate height that the ball bounce to the fourth bounce?

Answers: 2

Mathematics, 22.06.2019 02:00, PompousCoyote

Hey everyone! this question is a challenge question. for 50 points if you wish. all you have to do is answer the correct it has to be correct, in under 50 seconds, and i will make you the ! you want to accept this challenge. i already know! i mean, it's 50 free points! here is the question: 11x2= answer this correct, you get two prizes. don't forget. you only have 50 seconds or it wont happen. get it correct in under 50 seconds! that's not bad. so stop reading this long thing and !

Answers: 2

Mathematics, 22.06.2019 05:00, NathanFrase6770

There are 2 ones, 1 five,3tens, and 1 twenty. if there are 28 bills in her wallet, what would you predict is the approximate value of all the bills

Answers: 1

You know the right answer?

The price of a certain security follows a geometric brownian motion with drift parameter µ = 0.12 an...

Questions in other subjects:

Mathematics, 06.12.2021 22:20

Mathematics, 06.12.2021 22:20

Business, 06.12.2021 22:20

History, 06.12.2021 22:20

Mathematics, 06.12.2021 22:20