Mathematics, 15.11.2019 04:31 Naysa150724

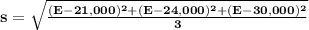

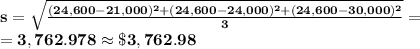

Assume that you expect to hold a $20,000 investment for one year. it is forecasted to have a year end value of $21,000 with a 30% probability; a year end value of $24,000 with a 45% probability; and a year end value of $30,000 with a 25% probability. what is the standard deviation of the holding period return for this investment?

Answers: 3

Other questions on the subject: Mathematics

Mathematics, 21.06.2019 21:30, cassandramanuel

Carl's candies has determined that a candy bar measuring 3 inches long has a z-score of +1 and a candy bar measuring 3.75 inches long has a z-score of +2. what is the standard deviation of the length of candy bars produced at carl's candies?

Answers: 1

You know the right answer?

Assume that you expect to hold a $20,000 investment for one year. it is forecasted to have a year en...

Questions in other subjects:

Biology, 21.10.2020 20:01

Chemistry, 21.10.2020 20:01

Mathematics, 21.10.2020 20:01

History, 21.10.2020 20:01

History, 21.10.2020 20:01

Mathematics, 21.10.2020 20:01