•for taxable income from $0 to $45,000, you pay 12% of it in taxes, plus

• for taxable income...

Mathematics, 11.11.2019 10:31 reinaelane77

•for taxable income from $0 to $45,000, you pay 12% of it in taxes, plus

• for taxable income from $45,001 to $200,000, you pay 25% of it in taxes, plus

• for taxable income from $200,001 to $500,000, you pay 35% of it in taxes, plus

• for taxable income of $500,001 or more, you pay 39.6%.

where the standard deduction was raised to $12,200 and the personal exemption was eliminated. for the remaining exercises, we will only consider this proposed tax plan.

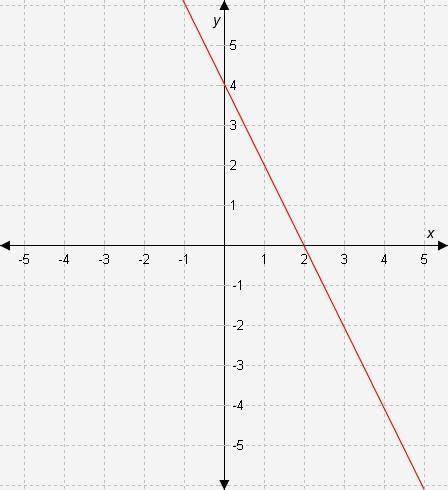

how many slopes would be on this graph?

write a function to model the total tax paid, t(x), with a total income of x dollars.

Answers: 3

Other questions on the subject: Mathematics

Mathematics, 20.06.2019 18:04, darrenmcfadden220

Super ultra mega important if you can answer this correctly i will give you 100 points but if you don't answer it correctly you'll get a big report. so stay aware and have a nice day!

Answers: 1

Mathematics, 21.06.2019 16:30, sydthekid9044

Divide the following fractions 3/4 ÷ 2/3 1/2 8/9 9/8 2

Answers: 2

Mathematics, 21.06.2019 18:30, starlightmoon213

The measure of one angle of an octagon is two times smaller that of the other seven angles. what is the measure of each angle?

Answers: 3

You know the right answer?

Questions in other subjects:

Physics, 07.10.2021 14:00

Computers and Technology, 07.10.2021 14:00

Biology, 07.10.2021 14:00

History, 07.10.2021 14:00

Social Studies, 07.10.2021 14:00