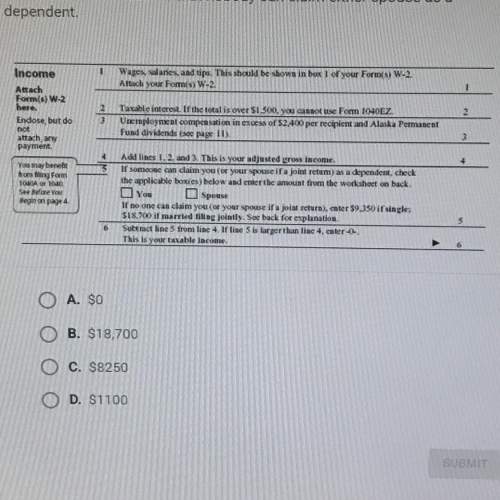

According to the income section shown below from the 1040ez form, in

married couple filing the...

Mathematics, 08.11.2019 19:31 cjdolce9790

According to the income section shown below from the 1040ez form, in

married couple filing their federal income tax return jointly enters 817,600 on

line 4 for adjusted gross income, what would they enter on line 6 for their

taxable income? assume that nobody can claim either spouse as a

dependent

Answers: 2

Other questions on the subject: Mathematics

Mathematics, 21.06.2019 17:30, aprilreneeclaroxob0c

Mrs. morton has a special reward system for her class. when all her students behave well, she rewards them by putting 3 marbles into a marble jar. when the jar has 100 or more marbles, the students have a party. right now, the the jar has 24 marbles. how could mrs. morton reward the class in order for the students to have a party?

Answers: 3

Mathematics, 21.06.2019 17:30, euraleecewilliams

1mile equals approximately 1.6 kilometers. which best approximates the number of miles in 6 kilometers?

Answers: 1

Mathematics, 21.06.2019 19:00, robert7248

Which of the expressions (on the photo document i inserted) together represent all solutions to the following equation? 8cos(12x)+4=-4 *the answer should be in degrees.* > i would like for someone to explain the process to find the solutions for this.

Answers: 2

Mathematics, 21.06.2019 22:40, zafarm2oxgpmx

Identify this conic section. x2 - y2 = 16 o line circle ellipse parabola hyperbola

Answers: 2

You know the right answer?

Questions in other subjects:

English, 13.02.2020 23:03

Mathematics, 13.02.2020 23:03

History, 13.02.2020 23:03