Mathematics, 17.09.2019 19:00 janahiac09

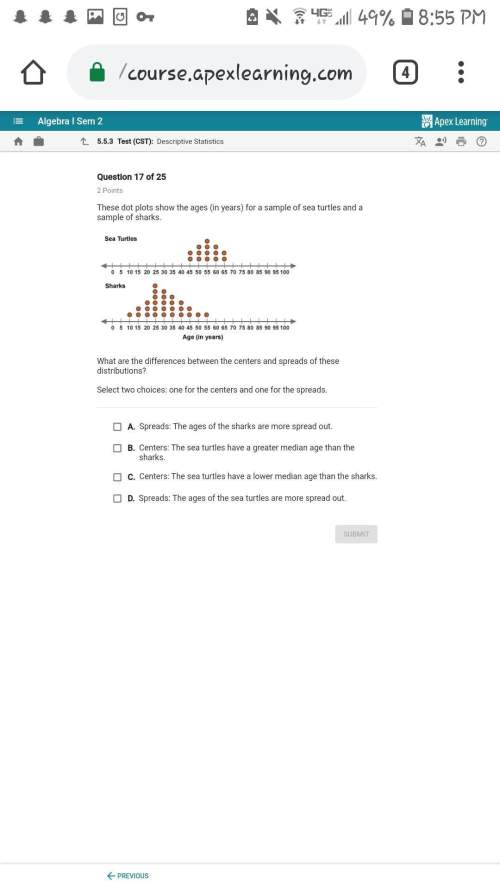

Marlene's taxable income is $95,000. use this tax schedule to calculate the total amount she owes in taxes.

if taxable income is over--

$0

$7,825

but not over--

$7,825

$31,850

$77,100

$160,850

$349,700

$31,850

the tax is:

10 percent of the amount o

$782.50 plus 15 percent of the amo

$4,386.25 plus 25 percent of the amo

$15,698.75 plus 28 percent of the am

$39,148.75 plus 33 percent of the am

$101,469.25 plus 35 percent of the am

$77,100

$160,850

$349,700

no limit

a.

$17,900.75

Answers: 2

Other questions on the subject: Mathematics

Mathematics, 21.06.2019 14:30, preshoo9941

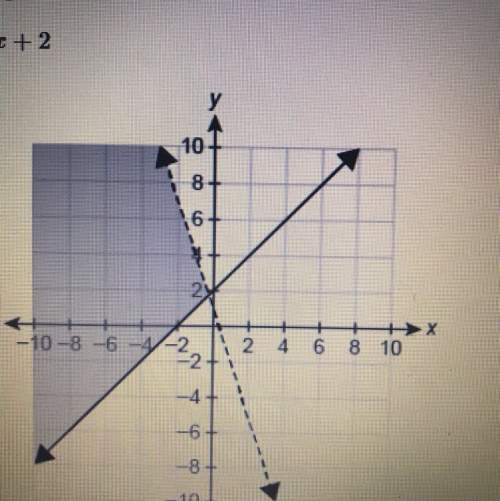

Find the zeros of the function. write the smaller solution first, and the larger solution second f(x)= (x+6)^2-49

Answers: 2

You know the right answer?

Marlene's taxable income is $95,000. use this tax schedule to calculate the total amount she owes in...

Questions in other subjects:

Mathematics, 01.04.2021 16:30

History, 01.04.2021 16:30

Social Studies, 01.04.2021 16:30

Mathematics, 01.04.2021 16:30