Computers and Technology, 02.10.2019 15:30 jgpjessi1854

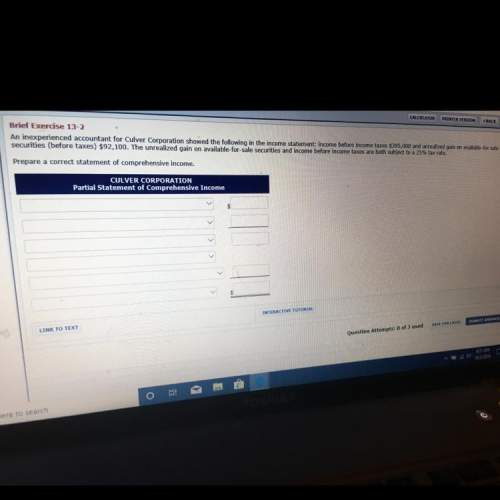

Asap! > > an inexperienced accountant for culver corporation showed the following in the income statement: income before income taxes $395,000 and unrealized gain on available-for-sale securities and income before taxes are both subject to a 25% tax rate.

Answers: 3

Other questions on the subject: Computers and Technology

Computers and Technology, 23.06.2019 11:30, talyku7131

Me dangers of social media and the internetexplain what each means: 1) social media and phones have become an addiction.2) outside people have access to you all the time.3) cyberstalking4) cyberbullying5) catphishing6) viruses7) identity theft8) credit card fraud9) hacking10) money schemes

Answers: 1

Computers and Technology, 23.06.2019 21:30, jayybrain6337

Enzo’s balance sheet for the month of july is shown. enzo’s balance sheet (july 2013) assets liabilities cash $600 credit card $4,000 investments $500 student loan $2,500 house $120,000 mortgage $80,000 car $6,000 car loan $2,000 total $127,100 total $88,500 which expression finds enzo’s net worth?

Answers: 1

Computers and Technology, 24.06.2019 09:30, nialphonsa

Atype of researcher who uses computers to make sense of complex digital data

Answers: 1

Computers and Technology, 25.06.2019 10:20, howme

(programming exercise 3-10). a retail company must file a monthly sales tax report listing the total sales for the month, and the amount of state and county sales tax collected. the state sales tax rate is 4 percent and the county sales tax rate is 2 percent. design a modular program that asks the user to enter the total sales for the month. from this figure, the application should calculate and display the following: - the amount of county sales tax - the amount of states sales tax - the total sales tax (county plus state) some of the code has already been provided below. complete the missing code below. // global constants for tax calculations constant real county_tax_rate = .02 constant real state_tax_rate = .04 // main module module main() // local variables declare real monthsales, countytax, statetax // get month sales display “enter monthly sales: ” input monthsales // write the statement to calculate county tax // write the statement to calculate state tax // display tax amount call showtaxes(monthsales, countytax, statetax) end module // the showtaxes module accepts monthsales, countytax, statetax // as arguments and displays the resulting data // write the showtaxes module

Answers: 2

You know the right answer?

Asap! > > an inexperienced accountant for culver corporation showed the following in the inc...

Questions in other subjects:

English, 03.03.2020 20:53

Mathematics, 03.03.2020 20:53

Mathematics, 03.03.2020 20:53