Business, 14.02.2022 22:00 annette211pdd8v9

Cordell Inc. experienced the following events in Year 1, its first year of operation:

Received $40,000 cash from the issue of common stock.

Performed services on account for $82,000.

Paid a $6,000 cash dividend to the stockholders.

Collected $76,000 of the accounts receivable.

Paid $53,000 cash for other operating expenses.

Performed services for $19,000 cash.

Recognized $3,500 of accrued utilities expense at the end of the year.

Required

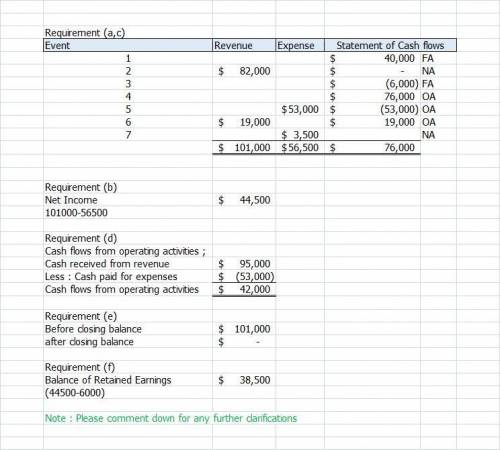

a. & c. Identify the events that result in revenue or expense recognition and those which affect the statement of cash flows. In the Statement of Cash Flows column, use OA to designate operating activity, FA for financing activity, or IA for investing activity. If the element is not affected by the event, leave the cell blank.

b. Based on your response to Requirement a, determine the amount of net income reported on the Year 1 income statement.

d. Based on your response to Requirement c, determine the amount of cash flow from operating activities reported on the Year 1 statement of cash flows.

e. What is the before- and after-closing balance in the service revenue account?

f. What is the balance of the retained earnings account that appears on the Year 1 balance sheet?

Answers: 1

Other questions on the subject: Business

Business, 22.06.2019 05:30, tommyaberman

Sally is buying a home and the closing date is set for april 20th. the annual property taxes are $1,234.00 and have not been paid yet. using actual days, how much will the buyer be credited and the seller be debited

Answers: 2

Business, 22.06.2019 17:00, allofthosefruit

Jillian wants to plan her finances because she wants to create and maintain her tax and credit history. she also wants to chart out all of her financial transactions for the past federal fiscal year. what duration should jillian consider to calculate her finances? from (march or january )to (december or april)?

Answers: 1

Business, 22.06.2019 20:20, cjp271

Xinhong company is considering replacing one of its manufacturing machines. the machine has a book value of $39,000 and a remaining useful life of 5 years, at which time its salvage value will be zero. it has a current market value of $49,000. variable manufacturing costs are $33,300 per year for this machine. information on two alternative replacement machines follows. alternative a alternative b cost $ 115,000 $ 117,000 variable manufacturing costs per year 22,900 10,100 1. calculate the total change in net income if alternative a and b is adopted. 2. should xinhong keep or replace its manufacturing machine

Answers: 1

Business, 23.06.2019 00:10, bthomas78

Special order carson manufacturing, inc., sells a single product for $36 per unit. at an operating level of 8,000 units, variable costs are $18 per unit and fixed costs $10 per unit. carson has been offered a price of $20 per unit on a special order of 2,000 units by big mart discount stores, which would use its own brand name on the item. if carson accepts the order, material cost will be $3 less per unit than for regular production. however, special stamping equipment costing $4,000 would be needed to process the order; the equipment would then be discarded. assuming that volume remains within the relevant range, prepare an analysis of differential revenue and costs to determine whether carson should accept the special order. use a negative sign with answer to only indicate an income loss from special order; otherwise do not use negative signs with your answers.

Answers: 2

You know the right answer?

Cordell Inc. experienced the following events in Year 1, its first year of operation:

Received $40...

Questions in other subjects:

English, 13.09.2020 22:01

Mathematics, 13.09.2020 22:01

Mathematics, 13.09.2020 22:01

Mathematics, 13.09.2020 22:01

Geography, 13.09.2020 22:01

Mathematics, 13.09.2020 22:01

Mathematics, 13.09.2020 22:01

Mathematics, 13.09.2020 22:01

Mathematics, 13.09.2020 22:01

Mathematics, 13.09.2020 22:01