Business, 25.01.2022 14:00 morganpl415

No

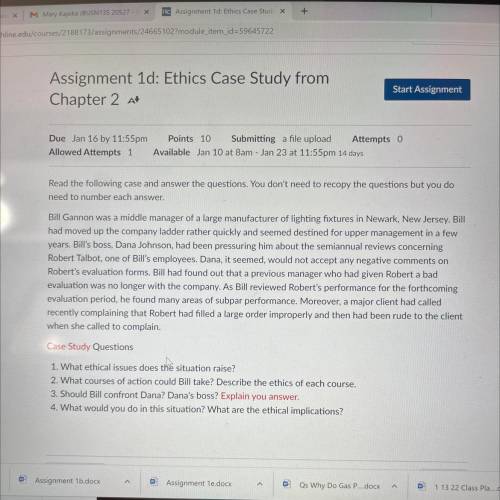

Read the following case and answer the questions. You don't need to recopy the questions but you do

need to number each answer.

Bill Gannon was a middle manager of a large manufacturer of lighting fixtures in Newark, New Jersey. Bill

had moved up the company ladder rather quickly and seemed destined for upper management in a few

years. Bill's boss, Dana Johnson, had been pressuring him about the semiannual reviews concerning

Robert Talbot, one of Bill's employees. Dana, it seemed, would not accept any negative comments on

Robert's evaluation forms. Bill had found out that a previous manager who had given Robert a bad

evaluation was no longer with the company. As Bill reviewed Robert's performance for the forthcoming

evaluation period, he found many areas of subpar performance. Moreover, a major client had called

recently complaining that Robert had filled a large order improperly and then had been rude to the client

when she called to complain.

Case Study Questions

1. What ethical issues does the situation raise?

2. What courses of action could Bill take? Describe the ethics of each course.

3. Should Bill confront Dana? Dana's boss? Explain you answer.

4. What would you do in this situation? What are the ethical implications?

Really need help

Answers: 3

Other questions on the subject: Business

Business, 21.06.2019 20:20, derpmuffin47

On february 3, smart company sold merchandise in the amount of $5,800 to truman company, with credit terms of 2/10, n/30. the cost of the items sold is $4,000. smart uses the perpetual inventory system and the gross method. truman pays the invoice on february 8, and takes the appropriate discount. the journal entry that smart makes on february 8 is:

Answers: 3

Business, 22.06.2019 01:20, tsadface21

Suppose a stock had an initial price of $65 per share, paid a dividend of $1.45 per share during the year, and had an ending share price of $58. a, compute the percentage total return. (a negative answer should be indicated by a minus sign. do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e. g., 32.16.) b. what was the dividend yield and the capital gains yield? (a negative answer should be indicated by a minus sign. do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e. g., 32.16.)

Answers: 2

Business, 22.06.2019 03:10, samantha636

On the first day of the fiscal year, a company issues an $7,500,000, 8%, five-year bond that pays semiannual interest of $300,000 ($7,500,000 × 8% × ½), receiving cash of $7,740,000. journalize the first interest payment and the amortization of the related bond premium. round to the nearest dollar. if an amount box does not require an entry, leave it blank.

Answers: 3

Business, 22.06.2019 08:40, alvalynnw

Mcdonald's fast-food restaurants have a well-designed training program for all new employees. each new employee is supposed to learn how to perform standardized tasks required to maintain mcdonald's service quality. due to labor shortages in some areas, new employees begin work as soon as they are hired and do not receive any off-the-job training. this nonconformity to standards creates

Answers: 2

You know the right answer?

No

Read the following case and answer the questions. You don't need to recopy the questions but yo...

Questions in other subjects:

Mathematics, 10.03.2020 22:37

Biology, 10.03.2020 22:37